Gold Fields Limited

NYSE:GFI or JSE:GFI

Equity Research on Gold Fields

Initiation on Gold Fields (JSE:GFI / NYSE:GFI)

Initiation on Gold Fields (JSE:GFI / NYSE:GFI) The following equity research report deep dives into…

Equity Research on Gold Fields (coming soon)

Business Overview

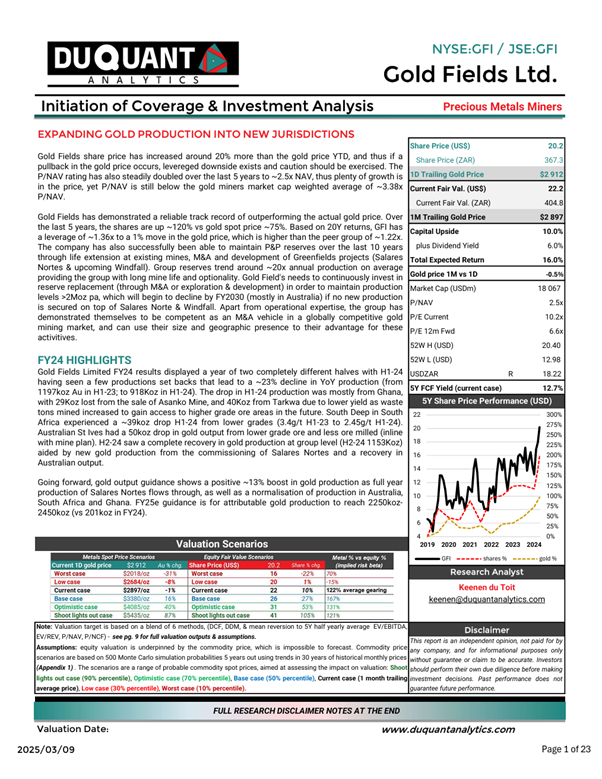

Gold Fields Limited is one of the largest global gold mining companies, with operations spanning multiple continents. Established in 1887 and headquartered in Johannesburg, South Africa, the company has evolved into a major producer, focusing on high-margin, sustainable gold mining operations. Gold Fields operates in five main regions, including South Africa, Ghana, Canada, Australia, and South America (Peru and Chile).

Gold Fields produces ~2400koz of gold per year, with proven and probable reserves to sustain production for >15 years. As of H2-2024 at a consolidated AISC of $1745/oz. Gold Fields is well-positioned to maintain its leadership in the gold mining sector, driven by its strong portfolio of assets, sustainability initiatives, and focus on operational excellence. The Salares Norte project in Chile will play a critical role in expanding production (additional ~300koz pa for 10 years) and securing future growth. The Osisko acquisition in Canada also adds positive growth prospects with the Windfall project also likely to add ~250-300koz of annual production once completed and running at full production..

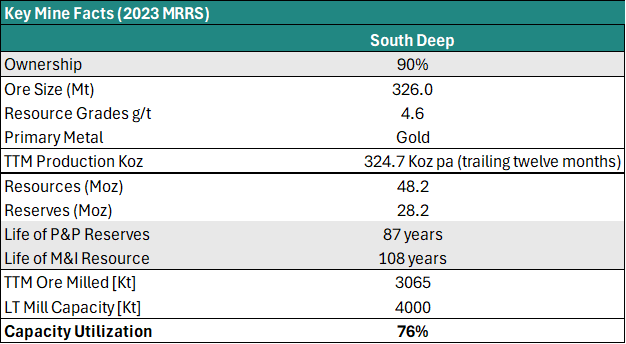

Segmental Overview 1: South Africa (~63% of P&P Gold Reserves)

South Deep Underground Mine

Gold Fields’ South Deep mine, located in the Witwatersrand Basin near Johannesburg, South Africa, is one of the world’s largest gold mines, with a significant mineral reserve base of 32.8 million ounces as of 2023. It is unique in being one of the deepest mechanized gold mines globally, reaching depths of approximately 3,000 metres. The mine operates an innovative, fully mechanized mining system designed to optimize safety and efficiency, a critical focus given the challenging conditions at such depths. South Deep also stands out for its long life-of-mine, estimated to extend beyond 70 years, which ensures its strategic importance in Gold Fields’ portfolio. The mine is committed to sustainability, actively pursuing renewable energy initiatives, including a 50 MW solar plant (visible on the image to the right) that powers operations. Despite historically facing challenges with production and costs, South Deep has undergone significant operational improvements, making it a critical asset for Gold Fields as it focuses on achieving stable, long-term output.

Source: Gold Fields 2023 Mineral Reserves & Resources Statement & own estimations

Map of Gold Fields South African Asset

Aerial View of South Deep

South Deep Mine Main Headgear

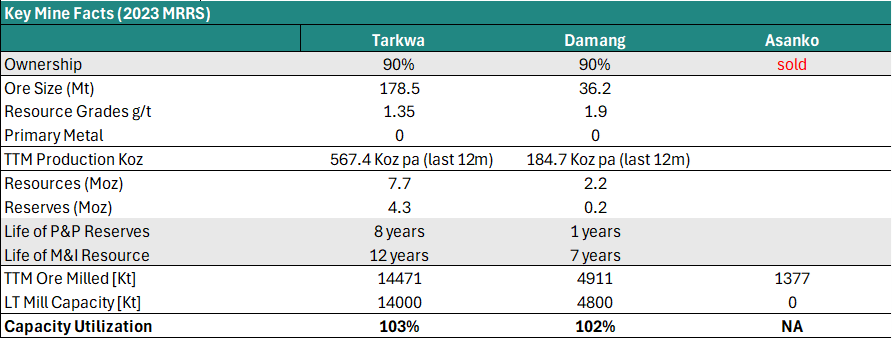

Segmental Overview 2: Ghana (~10% of P&P Gold Reserves)

Tarkwa Open Pit Mine

The Tarkwa Mine is one of the largest open-pit gold mines in Africa, with substantial reserves and production capabilities and around 12 years of life remaining. The mine employs conventional open-pit mining methods, utilising contractor mining and a carbon-in-leach (CIL) processing plant. In 2023, Gold Fields and AngloGold Ashanti entered into a joint venture (JV) agreement to merge their Tarkwa and neighboring Iduapriem mines. The combined operation aims to unlock synergies, increase production efficiency, and extend the mine life, leveraging both companies’ expertise. Gold Fields holds a 67% interest in the JV, while AngloGold Ashanti holds 33%, with the Ghanaian government maintaining a 10% free carried interest as mandated. This strategic partnership positions Tarkwa and Iduapriem as a dominant gold-producing hub in West Africa.

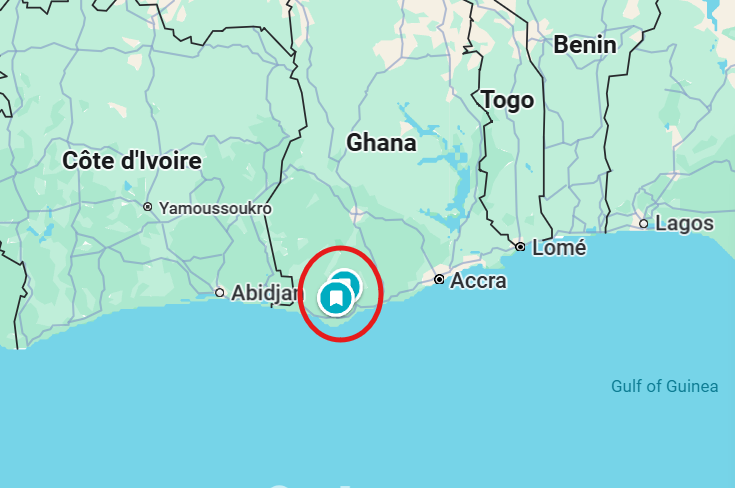

Map: Gold FIelds Ghana Operations

Tarkwa Aerial View

Tarkwa Processing Operations

Damang Open Pit Mine

The Damang open-pit operation located approximately 30 kilometres north of the Tarkwa mine. It has a rich history of production and is known for its high-quality ore and significant exploration potential. The mining operations ended in 2023, and the surface stockpile processing is expected to end in 2025. While the deposit still has 2.2 Moz of gold resources and a PFS for LoM extension has shown to be a value add, it has not met Gold Fields investment vriteria and has not been approved at this point in time.

Source: Gold Fields 2023 Mineral Reserves & Resources Statement & own estimations

Damang Open Pit

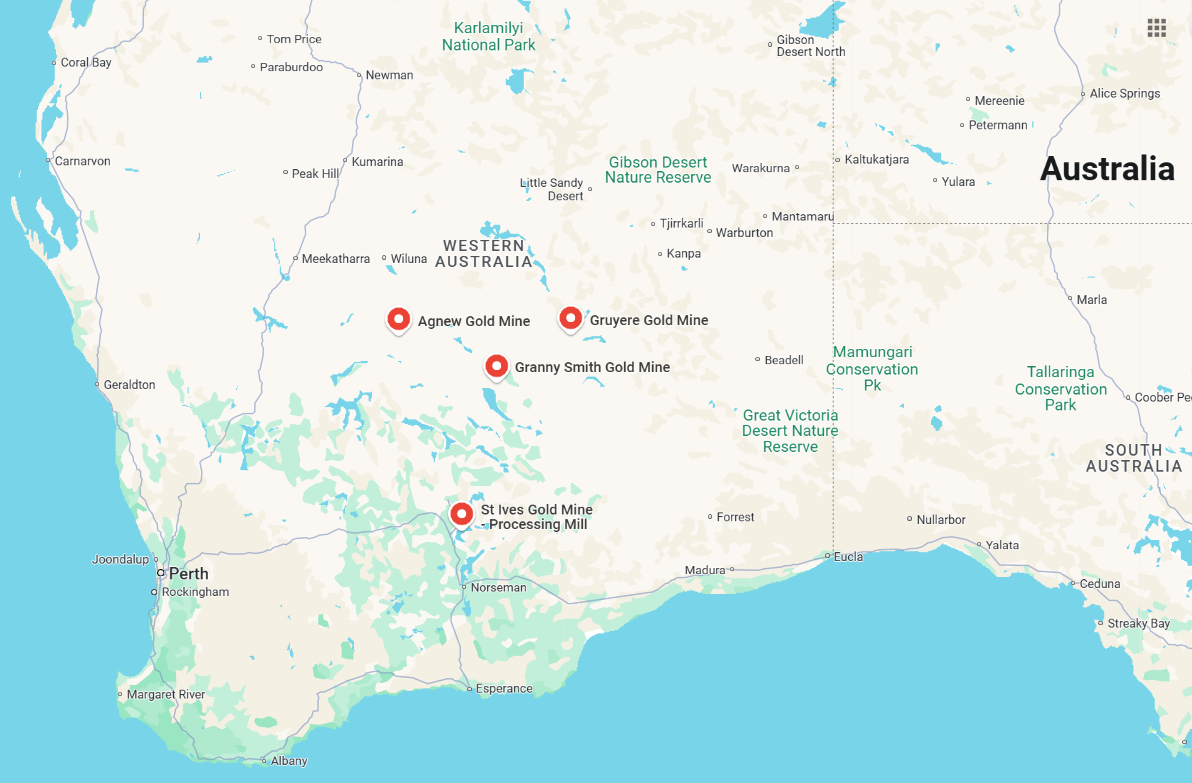

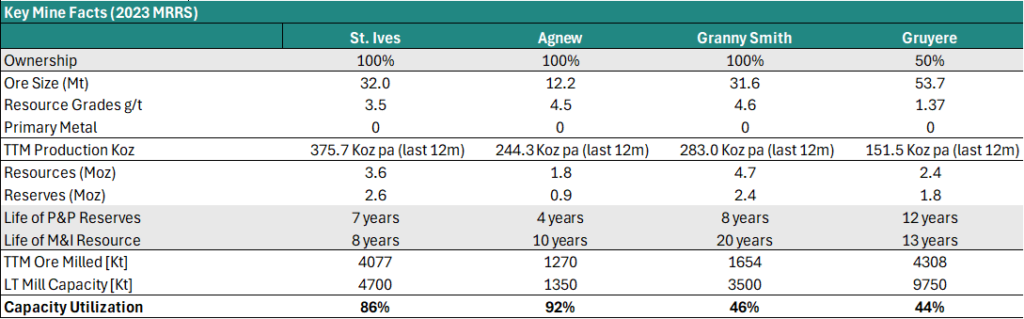

Segmental Overview 3: Australia (~21% of P&P Gold Reserves)

St Ives Underground Mines

~375koz of gold p.a. and 8 year LoM

Located in Western Australia near Kambalda, the St Ives Gold Mine is a significant open-pit and underground mining operation owned by Gold Fields. It spans a vast lease area covering over 112,000 hectares within the prolific Norseman-Wiluna Greenstone Belt. St Ives has consistently been a strong contributor to Gold Fields’ portfolio , producing high-grade ore from both its underground operations and surface mining projects. The site also boasts a state-of-the-art processing plant with a capacity of approximately 4.7 million tonnes per year. Recent exploration efforts continue to focus on extending the life of the mine by identifying new resource areas.

Map of Gold Fields Australian Assets

St Ives Aerial View

Agnew Underground Mines

~235koz of gold p.a. and 5 year LoM

Situated in the northern Goldfields region of Western Australia, Agnew Gold Mine is another key asset in Gold Fields’ portfolio . The mine primarily operates as an underground operation, with its high-grade ore sourced from the Waroonga and New Holland mining areas. Agnew is renowned for its innovation and was one of the first Gold Fields mines to fully transition to renewable energy, with the construction of a hybrid power plant combining wind, solar, battery storage, and gas. This commitment to sustainability reduces operating costs and enhances environmental performance. The processing plant at Agnew has a capacity of around 1.3 million tonnes per year.

Agnew Aerial View

Granny Smith Underground Mines

~280koz gold p.a. and 11 year LoM

Located near Laverton in Western Australia, Granny Smith Gold Mine is an underground operation centred around the Wallaby deposit. The mine has a history dating back to the 1980s and has delivered strong, steady production under Gold Fields’ ownership. Ore from the Wallaby deposit is mined at significant depths and transported to the site’s processing plant, which has a capacity of approximately 3.5 million tonnes annually. Granny Smith is also known for its focus on resource extension, with continued drilling programs aimed at increasing reserves and extending the mine life.

Granny Smith Aerial View

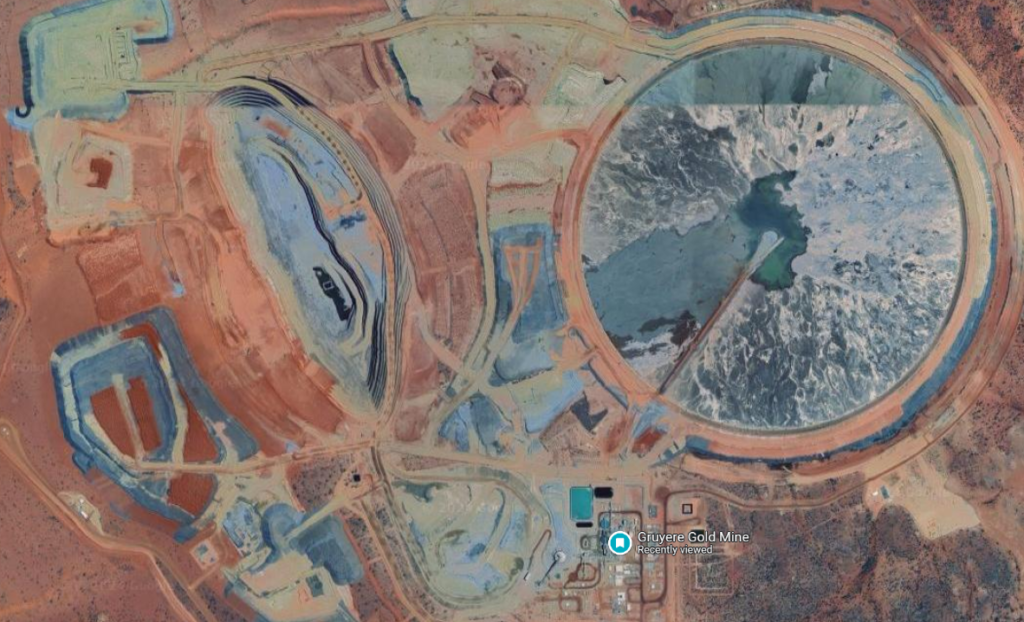

Gruyere Open-Pit Mines

~160koz gold p.a. and 10 year LoM

The Gruyere Gold Mine, a joint venture between Gold Fields (50%) and Gold Road Resources (50%), is located in the remote Yamarna Belt, about 200 kilometres east of Laverton, Western Australia. Gruyere is a large-scale, low-grade open-pit operation that has quickly become a cornerstone of Gold Fields’ Australian portfolio since commencing production in 2019. It features a conventional gravity and carbon-in-leach (CIL) processing plant with a capacity of 8.2 million tonnes annually. The JV partners continue to explore surrounding areas to extend the resource base and improve production efficiency, solidifying Gruyere’s position as a long-life, low-cost gold producer.

Gruyere Aerial View

Source: Gold Fields 2023 Mineral Reserves & Resources Statement & own estimations

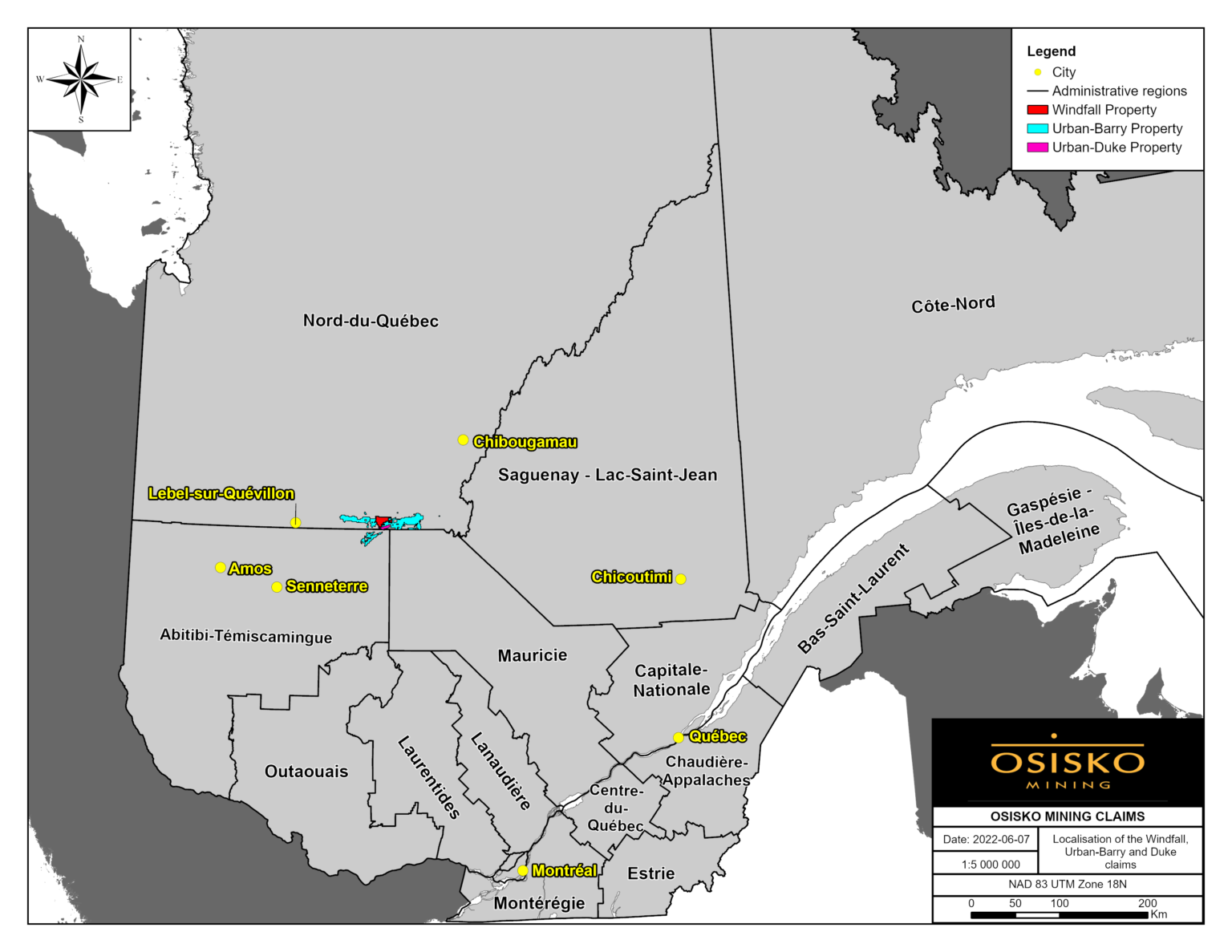

Segmental Overview 4: Canada (Osisko Assets)

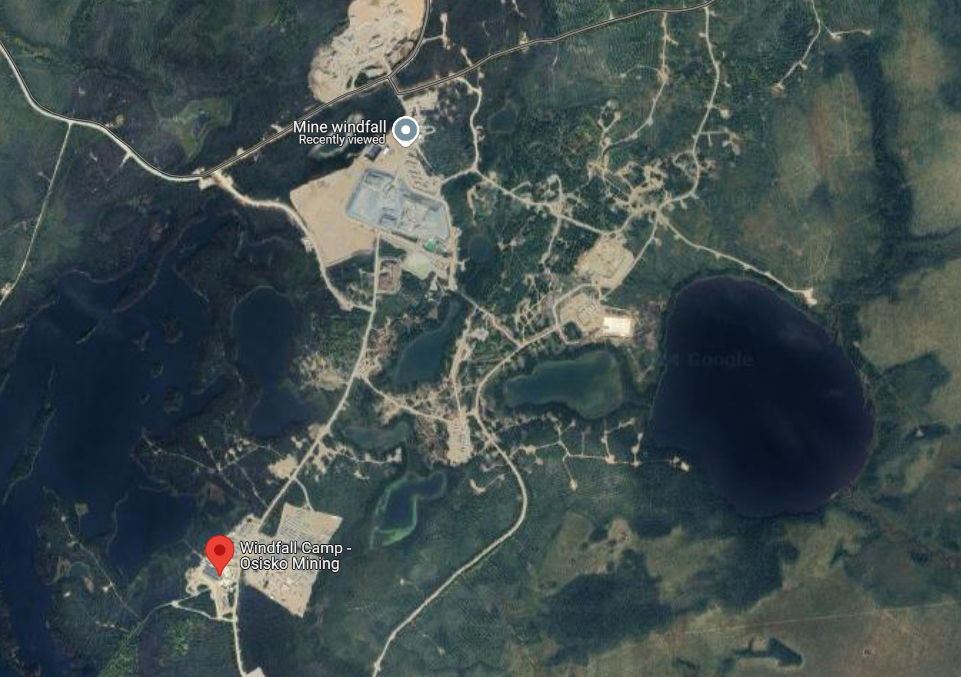

Windfall Mine

2022 BFS: ~306koz of gold p.a., AISC $758/oz, 10 year LoM

The Windfall Project, located in Québec’s prolific Abitibi greenstone belt, is a high-grade underground gold deposit and the flagship asset of the former Osisko Mining. Now wholly owned by Gold Fields following its acquisition of Osisko, Windfall is known for its exceptional ore grades and significant exploration potential. The project has advanced exploration and development, with a focus on high-grade veins, and it boasts robust economics highlighted in its feasibility studies. Once operational, Windfall is expected to become a cornerstone asset for Gold Fields, contributing to the company’s growth in a Tier 1 mining jurisdiction.

Urban Barry Project (50% JV)

Currently now measured resources.

The Urban Barry Project is a promising exploration property located near the Windfall deposit in the Urban-Barry Belt, a highly prospective area for gold discoveries. Now part of Gold Fields’ portfolio, the project includes several exploration targets that hold potential for high-grade gold mineralisation. Extensive drilling programs conducted by Osisko have identified numerous mineralised zones across the property. With Gold Fields’ expertise and resources, Urban Barry offers an opportunity to expand on the region’s gold endowment and extend the life of operations in the area.

Quévillon Project (50% owned)

Inferred Resource: 2.587 Mt at 6.13 g/t Au for 510 000 oz Au (2018)

The Quévillon Project, located southwest of the Windfall deposit, encompasses a vast area of underexplored greenstone belt with significant potential for gold discoveries. Previously owned by Osisko Mining, the project consists of a large land package that includes several high-priority exploration targets identified through geophysics and surface sampling. Now under Gold Fields’ ownership, Quévillon represents a strategic opportunity to unlock further value in the region through systematic exploration and resource delineation, complementing the nearby Windfall and Urban Barry assets.

Map of Gold Fields Canadian Assets

Osisko Acquisition: Deposit Map

Windfall Aerial View

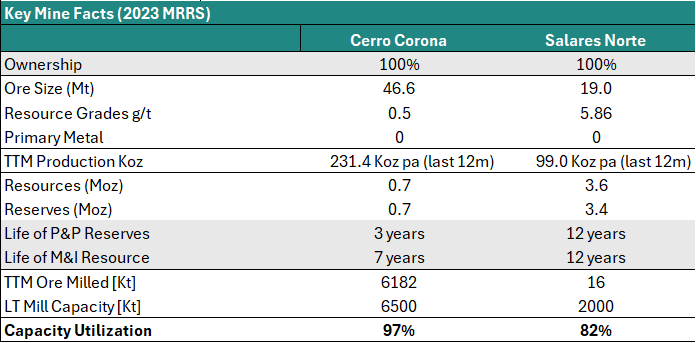

Segmental Overview 5: South America (Chile and Peru)

Salares Norte Mine

2023 Revised: ~300koz of gold p.a., AISC $744/GEoz, 10 year LoM

The Salares Norte gold-silver mine, located 4km above sea level in the Atacama Desert of northern Chile, began operations in 2024. This high-grade (~5-6g/t), epithermal open-pit deposit, with a life-of-mine (LOM) of 9 years, is expected to produce 4.2Moz of gold, 41.9Moz of silver, and 336Mlb of copper. The operation consists of two adjacent open pits—Brecha Principal and Agua Amarga—with ongoing brownfields exploration. Gold Fields approved the project’s development in 2020, following a positive feasibility study and environmental impact assessment. Construction continued in 2023, with commissioning and first gold pour anticipated in Q1 2024. The project has a payback period of 3 years, and an AISC of $744/oz of gold equivalent.

Situated at an altitude of >4,000 meters above sea level, the Salares Norte mine faces the potential for harsh weather conditions, such as severe winds, snow, and low temperatures, which can be common at such elevations. Management has put plans in place to minimize any adverse effects on mining operations.

Map of Gold Fields Chile Asset

Gold Fields Salares Norte

Salares Norte Aerial View

Peru: Cerro Corona Mine

~120koz of gold p.a. & 26kt copper, AISC $1525/GEoz, 5 year LoM

Cerro Corona, a porphyry-hosted gold-copper mine in Peru, produced 122koz of gold and 58.9Mlb of copper in 2023, processing 6.5Mt of ore. It is Gold Fields only mine with copper as a by-product. Despite heavy rainfall, ore hardness, and challenges such as non-competent limestone in the east wall and ground settlement, the mine met its material movement commitments for the year. The life-of-mine (LOM) plan over the next 5 years includes accelerated mining and stockpiling of low-grade ore for processing with in-pit tailings disposal from 2026 to 2030. A 2023 drilling campaign focused on gathering geological and geotechnical data, confirming the limits of skarn-style mineralisation, though it has not yet led to additional resource or reserve updates. Despite these challenges, Cerro Corona is well-positioned to meet its production targets until 2030.

Map of Gold Fields Peru Asset

Cerro Corona Aerial View

Cerro Corona gold-copper mill

Source: Gold Fields 2023 Mineral Reserves & Resources Statement & own estimations

Analyst Coverage and Research

Initiation on Pan African Resources (JSE:PAN / AIM:PAF [LSE or LON])

Initiation on Pan African Resources (JSE:PAN / AIM:PAF [LSE or LON]) The following equity research…

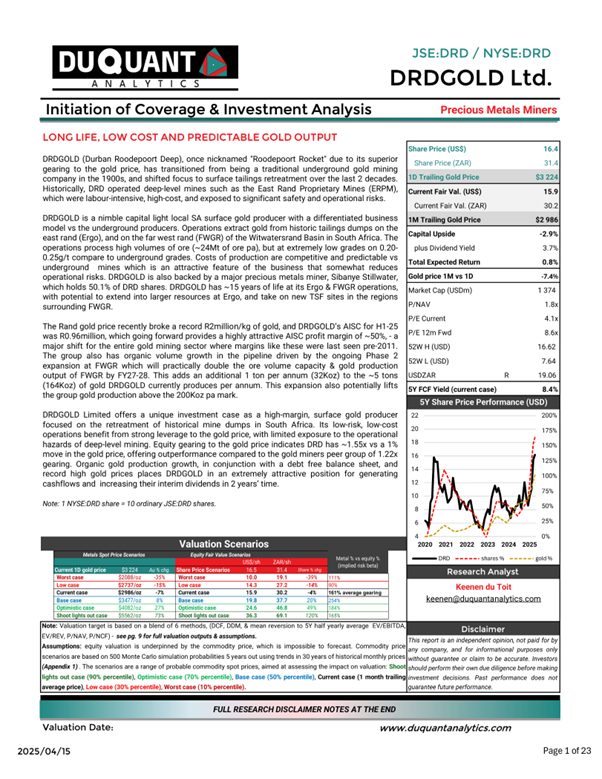

Initiation on DRDGOLD (JSE:DRD / NYSE:DRD)

Initiation on Gold Fields (JSE:GFI / NYSE:GFI)

Initiation on Gold Fields (JSE:GFI / NYSE:GFI) The following equity research report deep dives into…

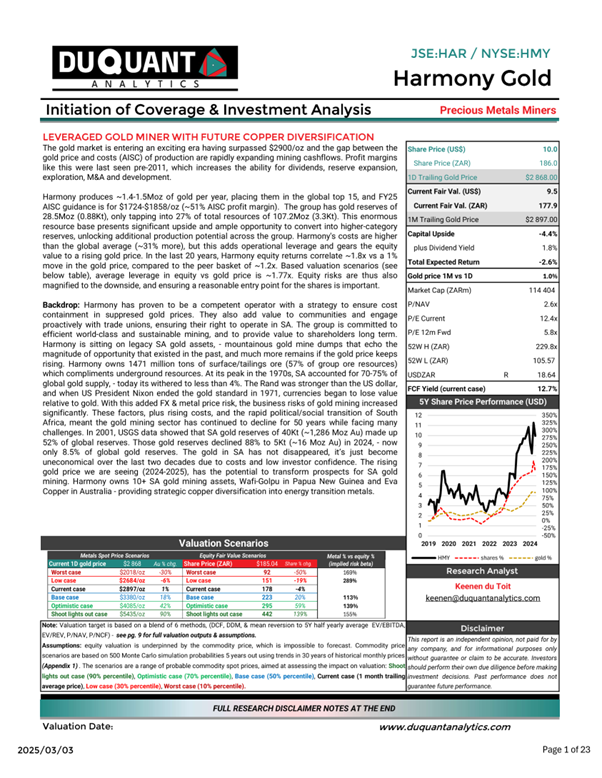

Initiation on Harmony Gold (JSE:HAR / NYSE:HMY)

Initiation on Harmony Gold (JSE:HAR / NYSE:HMY) The following equity research report aims to dive…

Navigating Gold

Navigating Gold What is so special about this lustrous yellow metal? Scientific Properties of Gold…