Navigating Gold

What is so special about this lustrous yellow metal?

Scientific Properties of Gold

Gold, with the chemical symbol Au and atomic number 79, is a scarce and valuable noble metal known for its exceptional resistance to corrosion and oxidation. It is remarkably malleable and ductile which allows it to be shaped into thin sheets or wires. Gold has a high density, distinct yellow colour, excellent thermal and electrical conductivity, and high reflectivity of light which makes it versatile for various applications. Gold has a melting point of 1064°C and a boiling point of 2856°C. All these properties that are unique to gold underpin its ongoing popularity and use.

Uses and Future Applications

Gold is a popular material used in jewellery and ornaments due to its lustre, malleability and resistance. It is also significant in terms of being used as a currency in the form of coins and bars/bullions and also as a form of investment. There are many physical gold backed exchange-traded funds (ETFs) providing investors with liquid exposure to the gold price, or investors and buy physical gold in a traditional form that is usually bought at a premium price and requires storage in vaults. Given that gold has excellent conductivity and resistance to corrosion it is also ideal for use in connectors, switches and components in electronics. Gold also has applications in Aerospace where gold coated materials are use in spacecraft and satellites for radiation shielding and reflective surfaces. Gold particles are also used in diagnostic tests and medical treatments such as targeted drug delivery systems and cancer therapies.

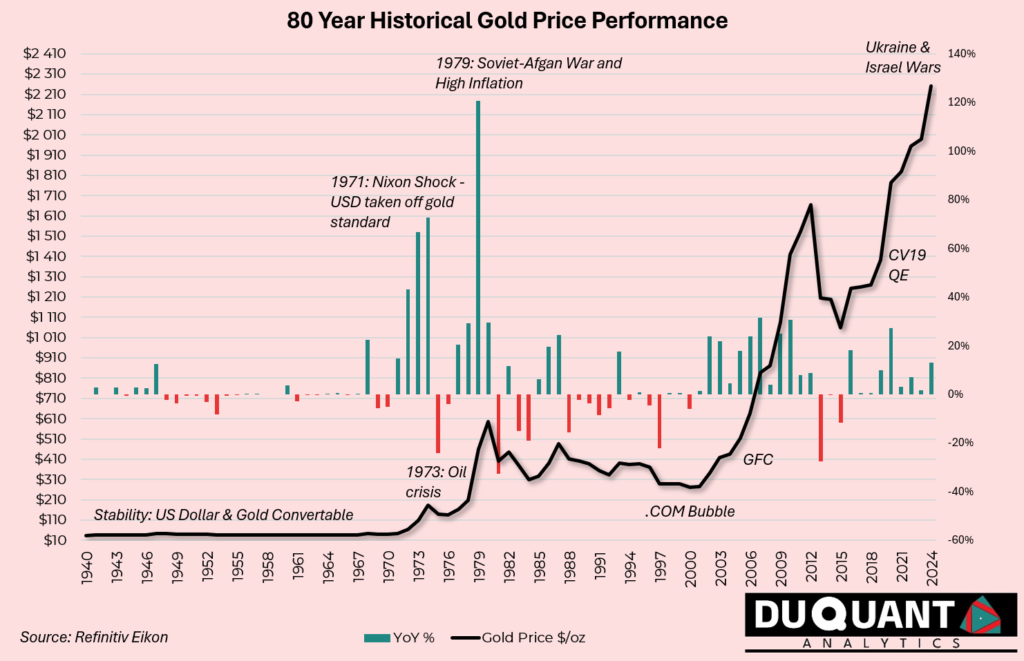

Given the increase in global tensions, rapidly expanding money supply and high inflation, we are likely to see a debasement in all fiat currencies. This is already being seen in the increase in gold price across all currencies to record highs in 2024. A technical breakout in the gold price of this size is likely to garner the attention of many investors. Given that majority of the buying has taken place by the east, we are likely to see further gold buying by western investors now that a bull market rally is in scope.

Largest Sources and Producers of Gold

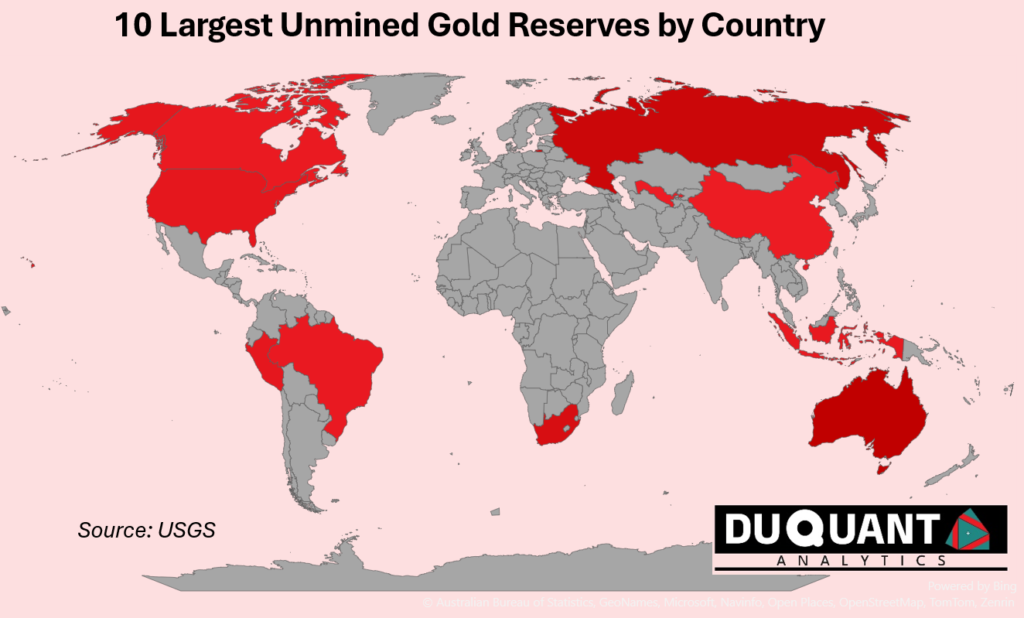

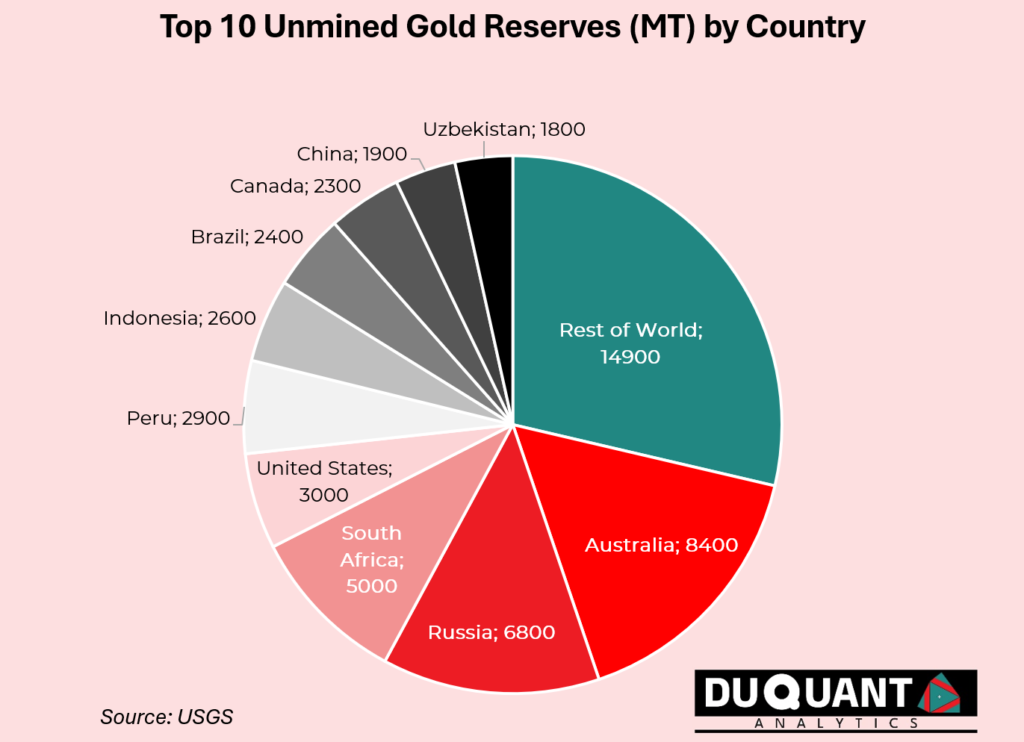

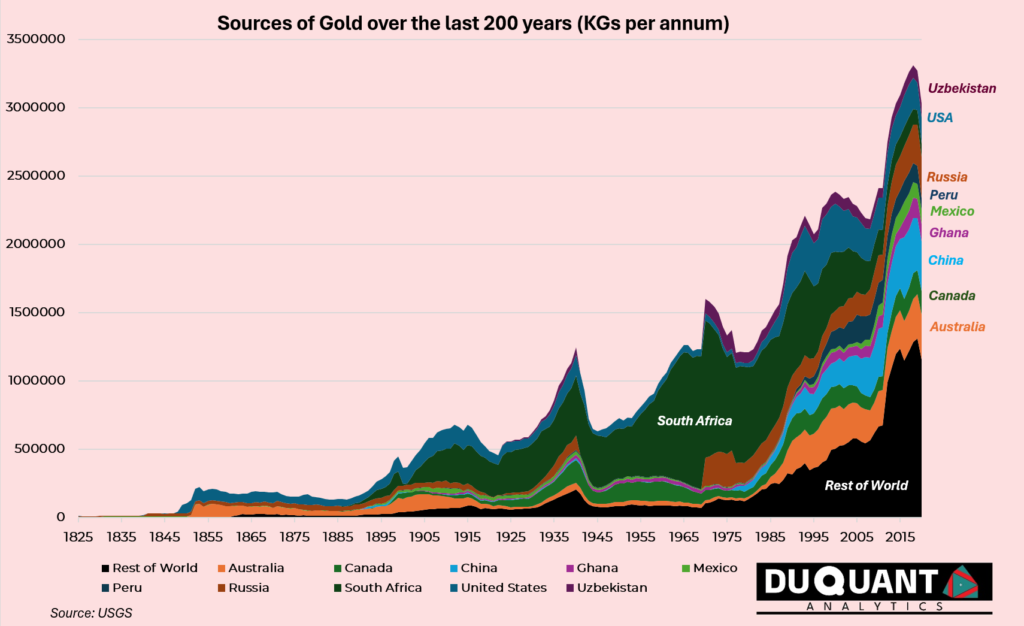

According to the US Geological Survey (USGS), global gold reserves stand at 52000 MT with the below countries making up the largest known reserves. The top 10 countries with the largest known reserves are Australia, Russia, South Africa, United States, Peru, Indonesia, Brazil, Canada, China and Uzbekistan.

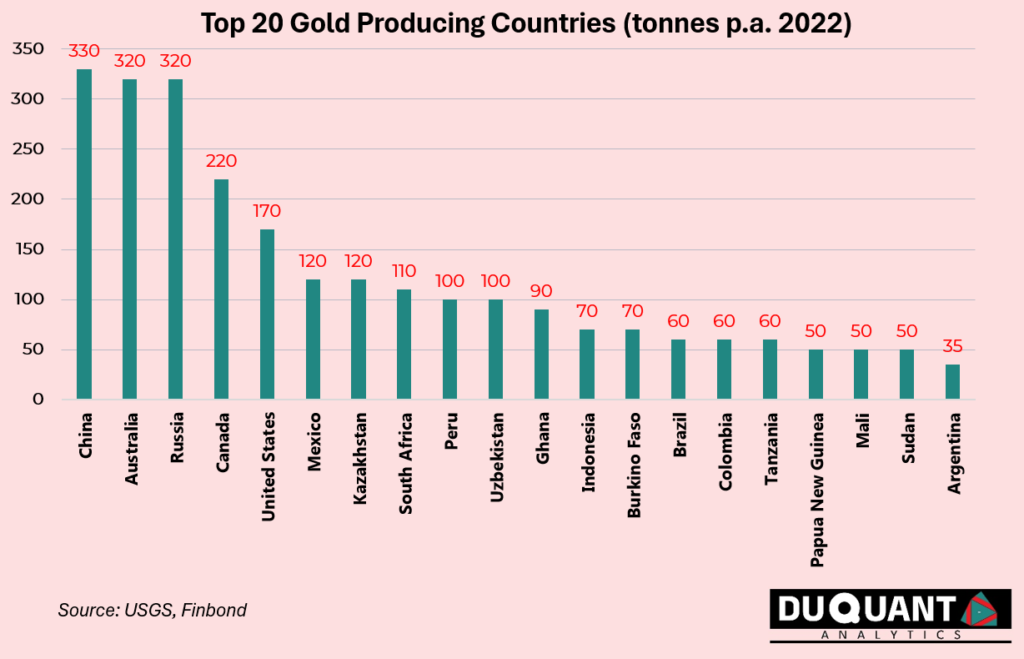

In terms of actual gold produced on an annual basis, there are differences compared to where most of the gold is situated. For example, China was the largest producer of gold in 2022 at 330 tons, but in terms of provable reserves by the USGS, China is seventh on the list, indicating that they are mining at a faster pace. These dynamics are largely driven my macro and micro economic factors that are unique to the individual jurisdictions, such as energy and labour costs, liquidity and access to funding, political stability and investor appetite. The lower the extraction costs, the more feasible it will be to mine. The figure below indicates the top 20 gold producing countries for 2022.

The Remarkable History of Gold

Gold has captivated humans for thousands of years, having shaped the world, cultures and forming the foundation for empires across and monetary systems across the globe. With gold being such a dense, heavy and non-corrosive element, this made it a convenient method of transporting value as coins. In the bartering economies of the past it was common to trade the weight of one commodity for another, thus the compact unit weight and value of gold was ideal as an exchange for other goods, and as a store of wealth that could be passed down to generations. From its revered use in ancient Egypt around 2600 BCE, the Egyptians covered their thrones in gold as an earmark of wealth and power. The minting of the first gold coins took place in Lydia around 600 BCE. The Roman Empire had its solidus coin that became the cornerstone of trade across Europe. In South America during the 18th century, the Brazilian Gold Rush led to the rise in cities like Ouro Preto and significant Portuguese colonial expansion. The 19th century brought more dramatic gold rushes, like the 1848 California Gold rush, and those in Australia in New South Wales and Victoria, which lead to mass migration as people searched for ‘the land of milk and honey’. The Klondike Gold Rush of 1896 drew thousands to Canada’s Yukon, despite the cold conditions. In 1886 the motherlode of all Gold discoveries took place in Johannesburg South Africa’s Witwatersrand Basin, which to this day has produced more than 30% of all gold mined in recorded history. South Africa still holds a significant portion of unmined gold, trapped deep within the earth with higher costs to sink shafts, which has become increasingly difficult to fund given the uncertainty and instability in South Africa.

Today, gold remains an integral part of the global economy, serving as a hedge against inflation and is remarkably uncorrelated to the markets during times of turmoil. The timeless allure of gold is multifaceted and continues to capture our curiosity. Since the US Dollar was taken off the gold standard in 1971, gold has become an important asset class for protecting wealth against inflation, geopolitical tensions and recessions.

Download This Post in PDF

RESEARCH DISCLOSURE

Purpose: DUQUANT Analytics provides research notes and newsletters for market insights, analysis, informational, educational, and research purposes only. We adhere to the CFA Institute’s Code of Ethics and Standards of Professional Conduct which includes maintaining the highest standards of integrity, transparency and professionalism in all research activities. We strive to ensure that our investment analysis and actions remain unbiased and focused on delivering accurate information based on available knowledge at the time of release. We follow industry accepted methodologies for conducting due diligence and conduct our analysis on a reasonable basis.

Investor Responsibility and Limitation of Liability: This content does not constitute a recommendation to buy or sell any securities. It is essential to understand the nature of our research, which is for educational and informative purposes. It is imperative to conduct your own due diligence and research prior to making any investment. DUQUANT Analytics is not liable for any losses incurred from using our research. Information released is believed to be reliable, but not guaranteed for accuracy or completeness. It is also important to note that past performance is not reflective of future performance.

Potential Conflict of Interest: Personal Investments: Members of DUQUANT Analytics may hold positions in some of the assets or securities mentioned in our research notes and newsletters. This includes equities, bonds, commodities and other financial instruments. Despite any personal investments, our research is conducted with the highest level of integrity, independence and objectivity. We strive to ensure that our analysis remains unbiased by focusing on accurate, public and provable information and secondary data as it is released or becomes public.

Conclusion: DUQUANT Analytics is committed to providing high-quality research and insights to our readers. However, it is essential for investors to take responsibility for their own investment decisions and to understand the inherent risks involve, especially in mining which carries more risk than traditional assets. We encourage you to consult with a qualified financial advisor and to perform thorough research before making any investments.

Thank you for reading this disclosure note. We value your trust and strive to maintain the highest standards of integrity in all our research activities.