Initiation on Gold Fields (JSE:GFI / NYSE:GFI)

The following equity research report deep dives into Gold Fields Limited (JSE:GFI / NYSE:GFI) with the aim to understand their mining operations, future potential and sensitivity of the equity valuation to gold price changes.

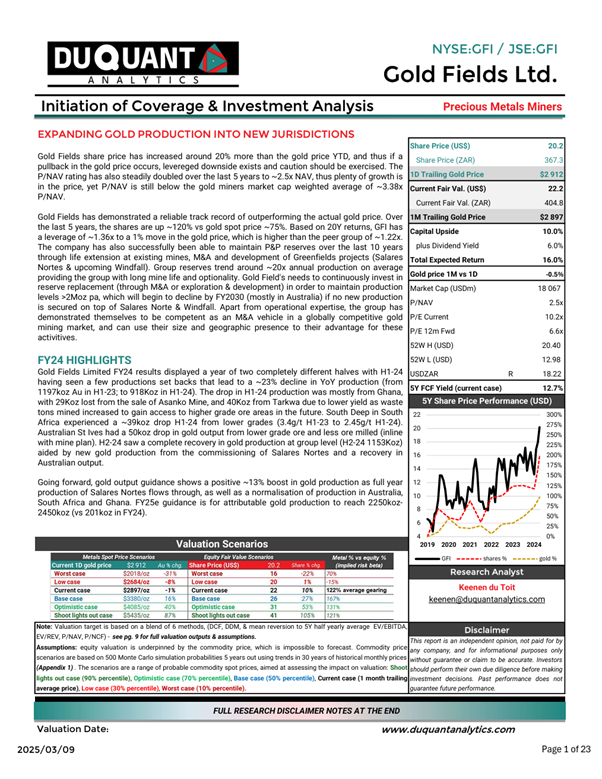

Gold Fields flagship asset is a South Deep in South Africa with 75 years of life. The group has fantastic global diversification with ~48% of gold production in tier 1 jurisdiction Australia, 32% of production from Ghana, and a strong reserve replacement pipeline including the ramp up of new Salares Norte (~300Koz+ Au pa) in Chile and the Windfall project (~300koz Au pa) in Canada, – which should be producing within the next 5 years. The equity valuation scenario analysis demonstrates significant leverage in the equity, ranging from 1.2 – 1.36x gearing to gold spot price changes, – both to the upside and downside.

Download Full Report in PDF (log in or create account to access)

RESEARCH DISCLOSURE

Purpose: DUQUANT ANALYTICS (PTY) LTD provides research notes and newsletters for market insights, analysis, informational, educational, and research purposes only and without guarantee. We strive to maintain a high degree of ethics which includes maintaining the highest standards of integrity, transparency and professionalism in all research activities. We strive to ensure that our investment analysis and actions remain unbiased and focused on delivering accurate information based on available knowledge at the time of release. We follow industry accepted methodologies for conducting due diligence and conduct our analysis on a reasonable basis.

Investor Responsibility and Limitation of Liability: This content does not constitute a recommendation to buy or sell any securities. It is essential to understand the nature of our research, which is based on assumptions that will differ in reality, thus the research is for educational and informative purposes only. It is imperative to conduct your own due diligence and research prior to making any investment. DUQUANT ANALYTICS (PTY) LTD is not liable for any losses incurred from using our research. Information released is believed to be reliable, but not guaranteed for accuracy or completeness. It is also important to note that past performance is not reflective of future performance.

Potential Conflict of Interest: Personal Investments: Members of DUQUANT ANALYTICS (PTY) LTD may hold positions in some of the assets or securities mentioned in our research notes and newsletters. This includes equities, bonds, commodities and other financial instruments. Despite any personal investments, our research is conducted with the highest level of integrity, independence and objectivity. We strive to ensure that our analysis remains unbiased by focusing on accurate, public and provable information and secondary data as it is released or becomes public. This report on Harmony Gold was not sponsored and DUQUANT ANALYTICS has not been paid to produce this content by any company.

Conclusion: DUQUANT ANALYTICS (PTY) LTD is committed to providing high-quality research and insights to our readers. However, it is essential for investors to take responsibility for their own investment decisions and to understand the inherent risks involve, especially in mining which carries more risk than traditional assets. We encourage you to consult with a qualified financial advisor and to perform thorough research before making any investments.

Thank you for reading this disclosure note. We value your trust and strive to maintain the highest standards of integrity in all our research activities.