Navigating Copper

The red metal powering the green revolution, the backbone of modern industry, and the world just cant get enough of it.

Scientific Properties of Copper

Copper is a versatile reddish metallic element renowned for its distinctive scientific properties. It belongs to Group 11 in the periodic table with atomic number 29 and symbol Cu, featuring a density of 8.96 g/cm³, a melting point of 1,085°C, and a boiling point of 2,562°C. In its pure form, copper exhibits a reddish-orange hue and a bright metallic luster. Chemically, it does not rust, but is moderately reactive when exposed to moist air, forming a protective green oxide layer over time. Copper also boasts exceptional electrical and thermal conductivity, crucial for applications in electrical wiring, electronics, and heat transfer systems. It is highly malleable and ductile, enabling it to be easily formed into sheets and wires. Widely alloyed, copper forms brass, bronze, and cupronickel, diversifying its applications across industries including construction, transportation, and manufacturing.

Uses and Future Applications

Copper is a versatile metal extensively utilized across various industries due to its excellent electrical and thermal conductivity, corrosion resistance, and malleability. The primary applications of copper include electrical and electronics, construction, transportation, industrial machinery, and renewable energy. In the electrical and electronics sector, copper is a fundamental component in wiring, motors, transformers, and generators because of its superior conductivity. It also plays a critical role in the production of printed circuit boards and various electronic devices. In construction, copper is widely used for plumbing, roofing, and cladding due to its durability and resistance to corrosion. The automotive industry relies on copper for vehicle wiring, radiators, and braking systems, with the rise of electric vehicles (EVs) significantly increasing demand in this sector. Additionally, copper is essential in the manufacturing of industrial machinery and equipment, such as heat exchangers and pumps. The renewable energy sector, particularly wind and solar power systems, depends heavily on copper for efficient and reliable energy transmission.

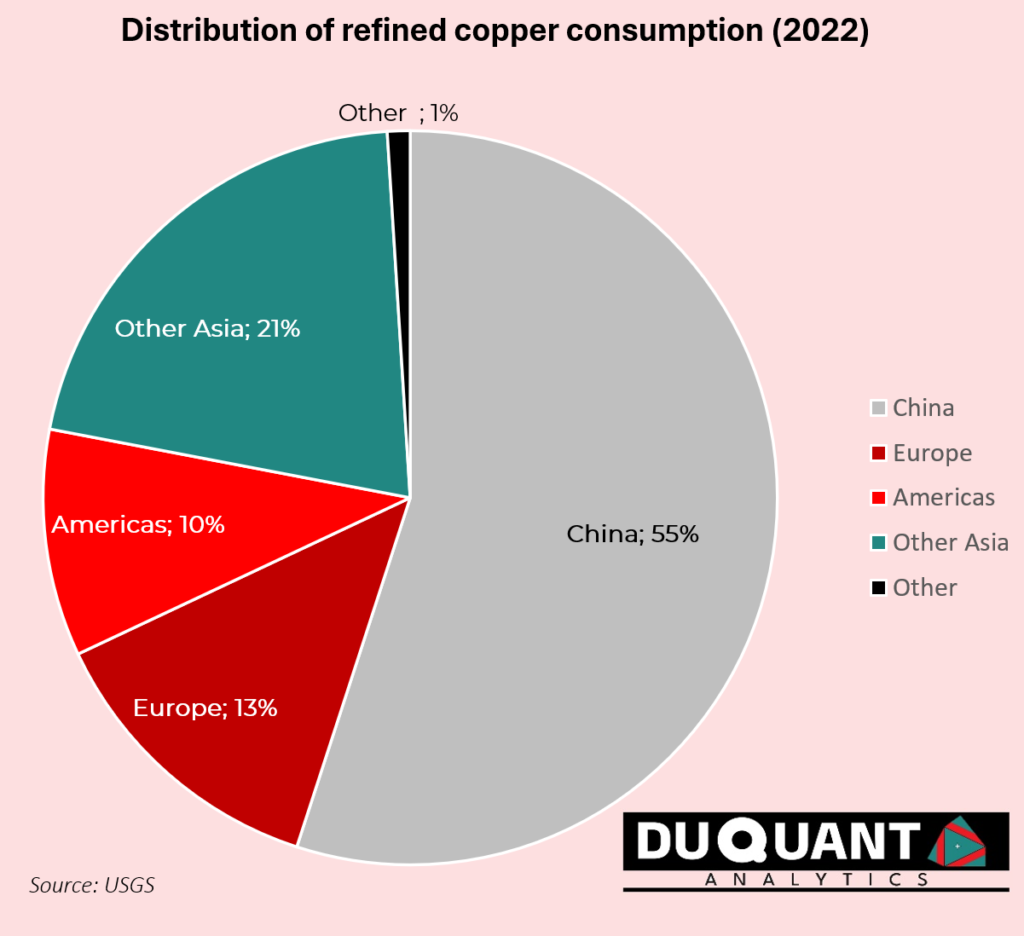

The demand for copper is largely driven by industrialization and urbanization in several key countries. China, as the world’s largest consumer of copper, accounts for nearly half of the global demand. The country’s vast manufacturing sector, rapid urban development, and investments in renewable energy and electric vehicles are primary drivers of copper consumption. The United States is also a significant consumer due to its extensive infrastructure, automotive industry, and burgeoning renewable energy projects. India, with its rapid economic growth and urbanization, is increasing its copper demand for infrastructure development, electrical grid expansion, and industrial manufacturing. In the European Union, the focus on green energy transitions and stringent environmental regulations is propelling copper demand, particularly in renewable energy and electric vehicle sectors.

Looking ahead, several factors are expected to drive the growth in copper demand. The global shift towards electric vehicles is a significant growth driver, as EVs use significantly more copper than traditional internal combustion engine vehicles, mainly in batteries, motors, and wiring. Investments in wind and solar power installations are set to surge, necessitating substantial copper use in power generation, transmission, and storage infrastructure. The development of smart grids and the broader electrification of various sectors will boost copper demand, as smart grids require extensive use of copper for efficient power distribution and management. The rollout of 5G networks will increase the need for copper in telecommunications infrastructure due to its role in enhancing signal transmission and network reliability. Green building initiatives and sustainable construction practices are likely to increase the use of copper due to its recyclability and efficiency in energy use. Moreover, the rise of industrial automation and the Internet of Things (IoT) will drive copper demand, as these technologies rely on extensive electrical and electronic components that use copper.

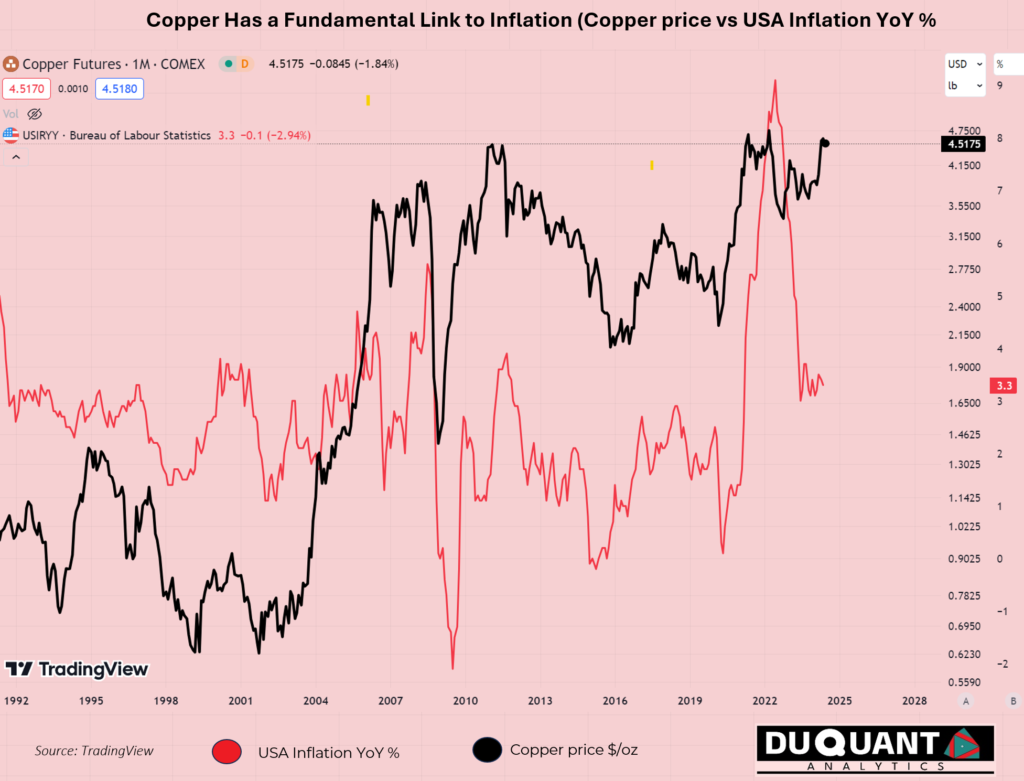

Due to copper being used across virtually all industries (as it enables the modern economy as it electrifies everything), it is a great leading indicator of economic activity and demand. Historically copper has thus been closely correlated to inflation and can also be viewed to visualized boom and largely bust cycles.

Copper remains a critical metal with diverse applications across several key industries. China, the United States, India, and the European Union are the major consumers, reflecting global industrial and urban growth trends. Future demand will be significantly influenced by the adoption of electric vehicles, renewable energy, smart grid technologies, 5G, and sustainable building practices. As these sectors expand, they will create substantial opportunities for growth in the copper market, making it a compelling area of focus for investors and industry stakeholders.

Largest Sources and Producers of Copper

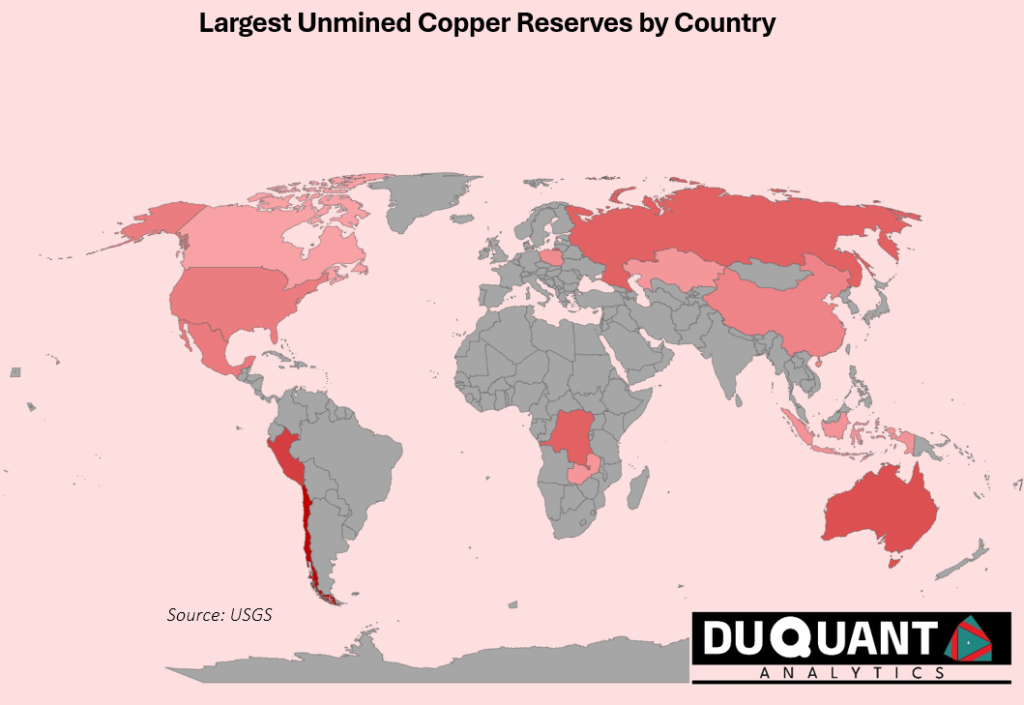

Copper is predominantly found in porphyry deposits and often also contain significant amounts of molybdenum, gold and silver. These types of deposits form from large intrusive ingenious bodies which form as a result of cooling magma. The Pacific Ring of Fire is an example of where continent tectonic plates meet and copper in porphyry deposits are found, i.e. Andes Mountains of Chile and Peru. Copper is also found in magmatic sulphide deposits that form from the cooling and crystallization of sulphide rich magmas which concentrates copper, nickel and other metals such as platinum group elements (PGE’s). Examples of these deposits are the Sudbury Basin in Canada. Norilsk-Talnakh in Russia, and the Bushveld Complex in South Africa.

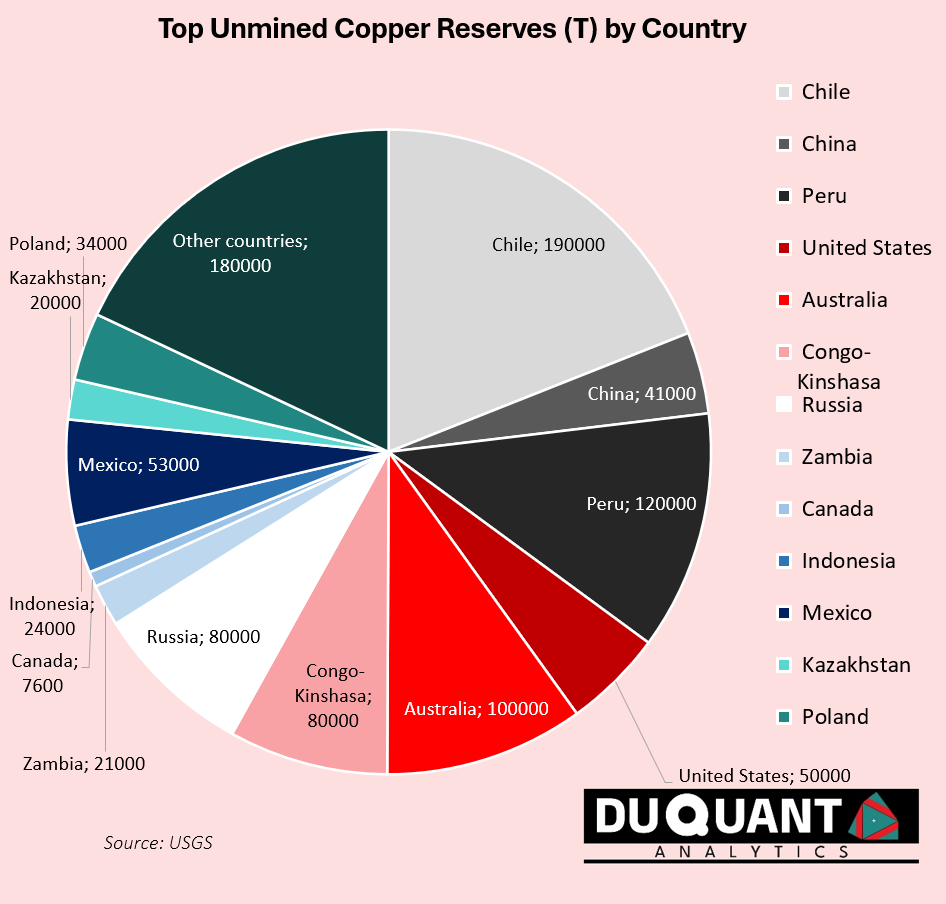

Copper is found all over the world and according to the 2024 US Geological Survey (USGS), global copper reserves stand at 1,000.6 million tons (Mt) with the largest reserves being Chile (190 Mt), Peru (120 Mt), Australia (100mt), Russia (80 Mt), Congo DRC (80Mt), Mexico (53 Mt), United States (50 Mt), and China (41 Mt). The remainder of the world makes up 286.6 Mt.

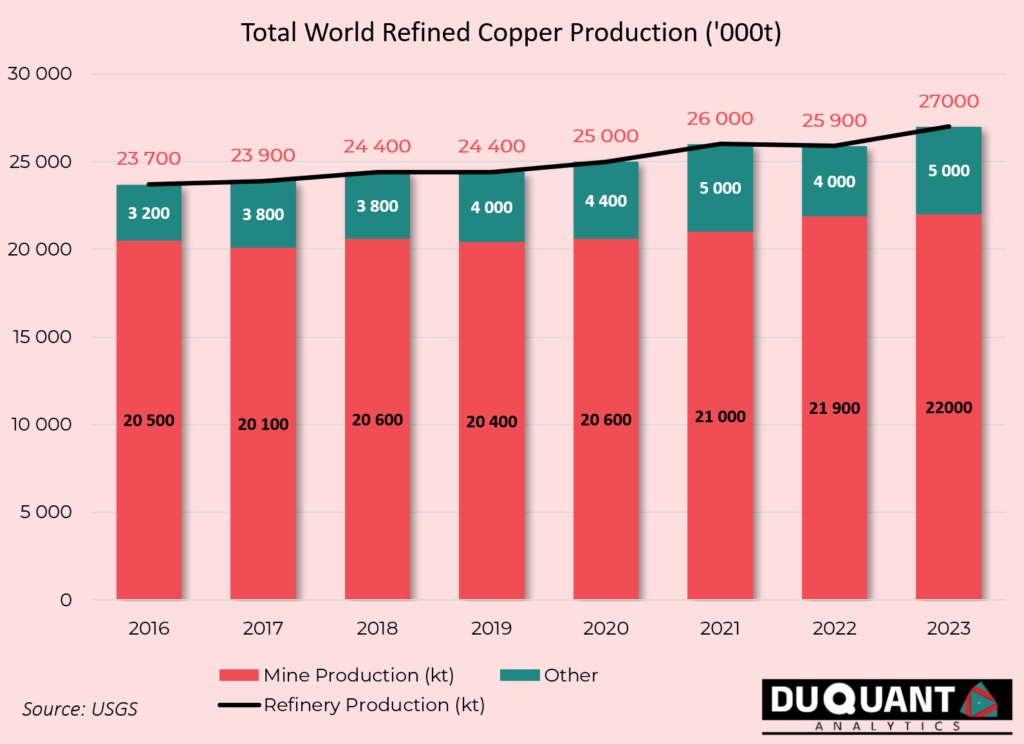

An important feature in the copper supply chain is the difference between mine production and refined production. Mine production includes the total copper ore or concentrate that is produced and sold directly from mines to be smelted. Refined production includes the total output from refining the copper ores/smelted copper into a pure 99.9% coper metal, – typically through electrolysis. As noted below the total refined copper is greater than the amounts produced by mines. The difference is due to refined production including the recycling of old scrap copper, refined net imports and inventory changes.

Based on the above it is clear that there is a complex global supply chain, from miners, to smelters to refiners. As at 2024, according to the USGS, China is the largest copper refiner and refined production of copper from China in 2023 was 12,000 Kt, which is 44.4% of the world’s total 27,000 Kt of refined copper production.

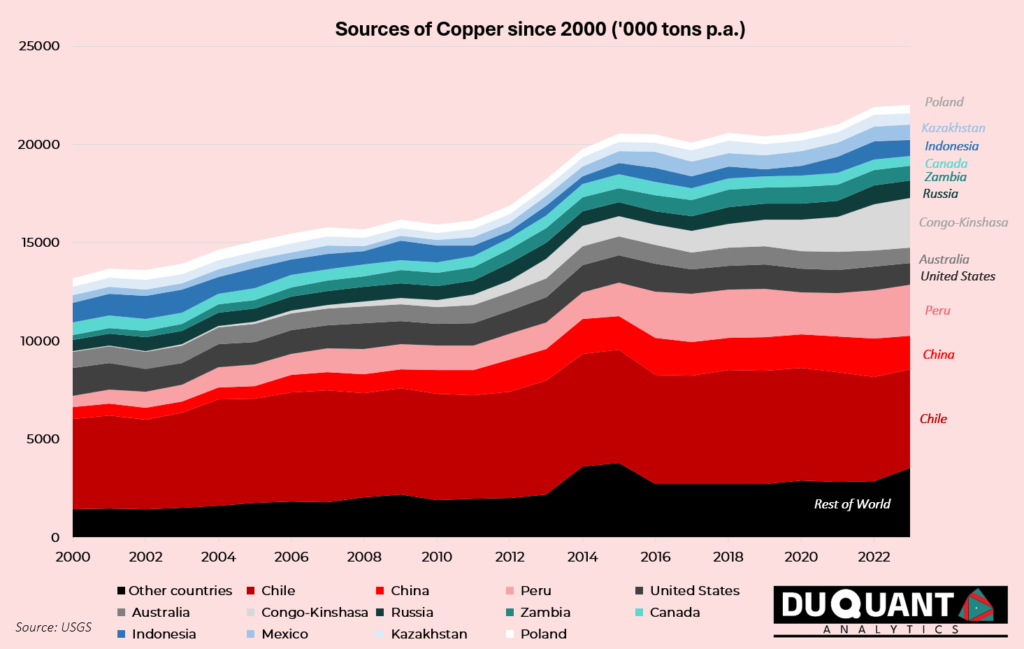

In terms of total annual mine production, since 2000 approximately 31% of copper came from Chile, 9% from Peru, 7% from United States, 7% from China, 5% from Australia, and the remainder of the world producing 41% of mined copper since 2000. The below figure shows the trends of the world’s largest copper miners since 2000.

At current mine production rates and reserves, the world has c.45.5 years life remaining on copper reserves, which is a fundamental driver leading to upside potential in the copper price. Given the need to rapidly shift to low carbon-based energy solutions, the demand side of copper is also likely to increase dramatically.

The Remarkable History of Copper

Copper, a metal prized for its versatility and conductivity, has a storied history that spans over ten millennia. The story of copper mining began around 8,000 BCE when early humans discovered the metal’s unique properties. The earliest known use of copper was in Anatolia (modern-day Turkey) where Neolithic communities used it to create tools, beads, ornaments, and weapons, marking the dawn of the Copper Age. By 3,500 BCE, the metal’s extraction and smelting had advanced significantly, contributing to the rise of early civilizations in Mesopotamia and Egypt. Copper was one of the first metals that men learnt to smelt, and when smelted with tin, it would form bronze, and when mixed with zinc, it would form brass, which was a game changer for weapons and armour.

In ancient Egypt, copper was essential in the construction of tools and the adornment of pharaohs. The famous Great Pyramid of Giza, completed around 2,560 BCE, was said to have been built using copper tools. Simultaneously, the metal found widespread use in Mesopotamia, where the Sumerians and Babylonians harnessed it for weapons, art, and currency. As civilization progressed, so did the demand for copper. By around 2,500 BCE, copper mining had spread to the island of Cyprus, which would become synonymous with the metal itself (the name “copper” is derived from the word “Kupros,” which is Greek for ‘Cyprus’). Cypriot copper was a cornerstone of Mediterranean trade, and fueled the growth of powerful city-states and empires across the region. In ancient Greece and Rome, copper was integral to daily life and commerce. The Romans, were adept at large-scale copper mining and developed extensive mining supply chains throughout their empire, in central Europe, Spain and Britain. Spain in particular is where the Rio Tinto mines became legendary for their output. Eventually copper coins a standard currency and the metal’s utility in tools, plumbing and construction underscored its importance.

Fast forward to the discovery of the Americas, which was an era that saw a seismic shift in copper mining. In the 16th century, the Spanish conquerors encountered rich copper deposits in South America, particularly in the Andes Mountains of Chile and Peru. These were discoveries that contributed significantly to the European economies, as they were much larger deposits than those found across Europe. Copper supply from the Americas helped sustain the expanding transatlantic trade. The 19th century experienced the onset of the Industrial Revolution, which dramatically increased the demand for copper. The invention of the steam engine and the telegraph, both relied heavily on copper and thus spurred a surge in copper mining activity. Significant deposits were discovered in the United States which became a key supply. The Copper Rush in Michigan’s Upper Peninsula during the mid-1800s heralded the United States as a major player in copper production. The Keweenaw Peninsula also became known as “Copper Country,” which yielded vast quantities of copper. In Chile, the Chuquicamata mine was also discovered, which is the world’s largest open-pit copper mine, and placed Chile as a leading copper producer still to this day.

The 1900s brought technological advancements and market volatility that reshaped the global copper industry. One of these events was the introduction of electrical wiring, which relied heavily on copper due to its superior conductivity. This development, coupled with the burgeoning automobile industry, solidified copper’s indispensability. In 1932, the US government passed the Gold Standard Act, which, among other things, influenced copper prices and production. The Act’s economic impact highlighted copper’s integral role in the broader economy. During the 1940s in World War II, copper’s importance surged again, as it was essential for military hardware and communication systems. There was later a post-war boom that saw copper demand skyrocket as nations rebuilt their infrastructure. The 1950s and 1960s witnessed significant technological innovations, including improved mining techniques and smelting processes, which enabled a large increase in production efficiency and output. Chile continued to dominate the copper market and eventually nationalised its mines in the 1970s.

Today, copper mining is a globally integrated industry with significant mine production in Chile, the United States, Peru, China, and the Democratic Republic of the Congo. The largest consumer is China, being a manufacturing base for the world, and China also holds the largest refinery capacity. Advances in technology have enabled more efficient extraction and processing, meeting the ever-growing demand for this versatile metal. Copper is indispensable in the modern world, used in everything from electrical wiring, technology, electronics, plumbing and renewable energy technologies. The push towards green energy will be a major driver for increased future demand, as copper is critical for wind turbines, solar panels, and electric vehicles.

As the world transitions to renewable energy and electric vehicles, copper’s importance will grow. The metal’s superior conductivity and versatility make it indispensable for future technologies. With ongoing advancements in mining techniques and a focus on sustainability, copper will continue to play a pivotal role in shaping the future of our world. As pointed out by an analysis of current global reserves of copper of c.1 billion tons, and an annual mine production of 22 Mt, the world has roughly 45.5 years left in its reserves. Notwithstanding, new reserves could be discovered, and recycling of copper could become a larger portion of future refined copper supply.

From its ancient beginnings in the Middle East, the Roman Empire, fast forwarded to today, copper’s central role in modern technology is a testament to its enduring value and significance. Its journey is one of volatility, innovation, adaptation, and resilience, and remains at the forefront of human progress and building a sustainable future.

Download This Post in PDF

RESEARCH DISCLOSURE

Purpose: DUQUANT Analytics provides research notes and newsletters for market insights, analysis, informational, educational, and research purposes only. We adhere to the CFA Institute’s Code of Ethics and Standards of Professional Conduct which includes maintaining the highest standards of integrity, transparency and professionalism in all research activities. We strive to ensure that our investment analysis and actions remain unbiased and focused on delivering accurate information based on available knowledge at the time of release. We follow industry accepted methodologies for conducting due diligence and conduct our analysis on a reasonable basis.

Investor Responsibility and Limitation of Liability: This content does not constitute a recommendation to buy or sell any securities. It is essential to understand the nature of our research, which is for educational and informative purposes. It is imperative to conduct your own due diligence and research prior to making any investment. DUQUANT Analytics is not liable for any losses incurred from using our research. Information released is believed to be reliable, but not guaranteed for accuracy or completeness. It is also important to note that past performance is not reflective of future performance.

Potential Conflict of Interest: Personal Investments: Members of DUQUANT Analytics may hold positions in some of the assets or securities mentioned in our research notes and newsletters. This includes equities, bonds, commodities and other financial instruments. Despite any personal investments, our research is conducted with the highest level of integrity, independence and objectivity. We strive to ensure that our analysis remains unbiased by focusing on accurate, public and provable information and secondary data as it is released or becomes public.

Conclusion: DUQUANT Analytics is committed to providing high-quality research and insights to our readers. However, it is essential for investors to take responsibility for their own investment decisions and to understand the inherent risks involve, especially in mining which carries more risk than traditional assets. We encourage you to consult with a qualified financial advisor and to perform thorough research before making any investments.

Thank you for reading this disclosure note. We value your trust and strive to maintain the highest standards of integrity in all our research activities.