Navigating Lithium

What is it about lithium that has catapulted this once-overlooked metal to the forefront of the global energy race?

Scientific Properties of Lithium

Lithium is a soft, silvery-white alkali metal with atomic number 3 and symbol Li. It has a low density of 0.534 g/cm³, making it one of the lightest metals. Lithium is softer than lead and is ductile (i.e. being able to be drawn into wire). Lithium is highly reactive, especially with water, and when exposed to air it tarnishes rapidly. Lithium also exhibits excellent electrochemical properties, making it crucial for rechargeable batteries (lithium-ion batteries). It was only until the 1960s-70s that batteries were discovered, and thus lithium has always been a scientific curiosity prior to the discovery.

Uses and Future Applications

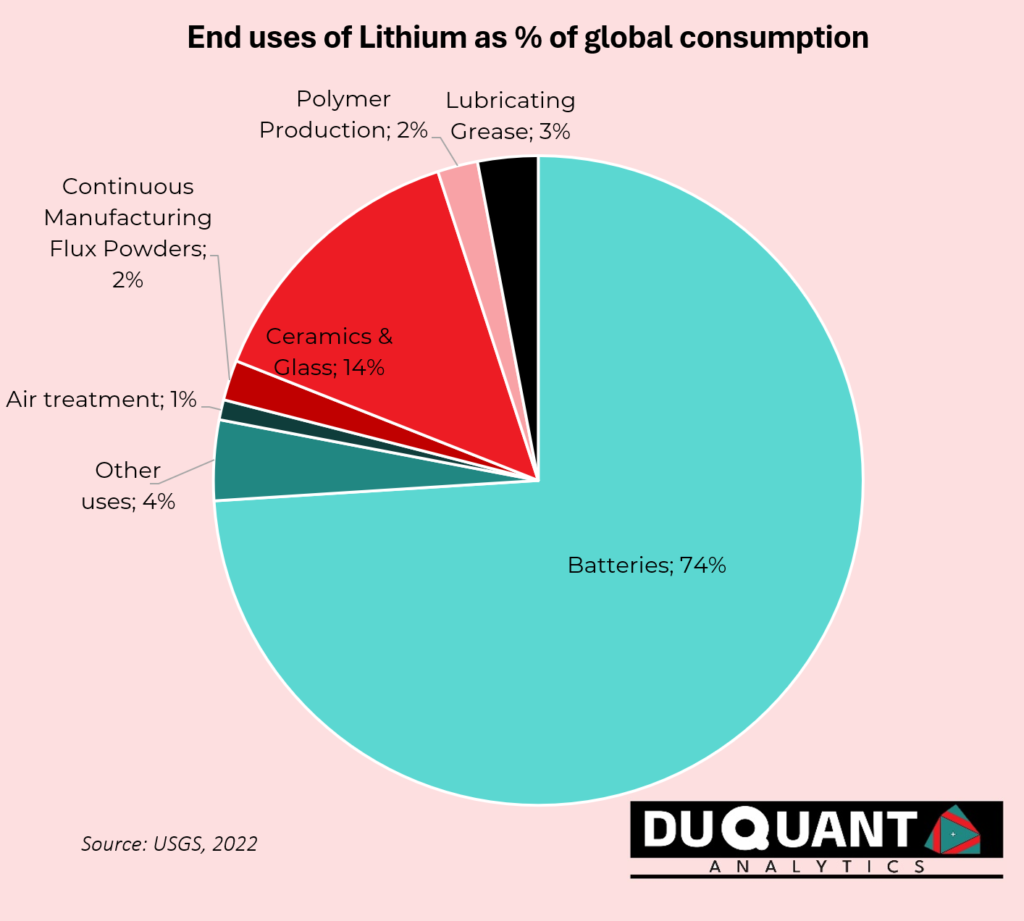

Due to the electrochemical properties of lithium, its primary use is in rechargeable lithium-ion batteries which are widely used as energy sources in portable electronics, laptops and phones, electric vehicles, and off/on grid energy storage systems. Lithium’s use in batteries makes up a massive 74% of global lithium consumption. In 2022, China made up 77% (893GWh) of global battery manufacturing capacity, followed by Poland (6%), USA (6%) and the rest of the world at 11%. The growing EV and renewable off and on grid energy storage markets will likely continue to be a major driver of lithium demand into the future. Despite other battery types (like molten salt batteries) that are being produced, it is likely that lithium batteries will still be quite important for the energy storage market, especially since the mining and lithium-ion battery production capacity already exists.

Lithium’s second largest use is in ceramics and glass. The use in ceramics, specialty glass, glassware or ceramic cookware, is due to when lithium is present, it enhances the thermal shock resistance and strength of the final product. This also helps the ceramics and glass withstand rapid temperature changes such as during cooking, or enables glass to have more strength when used in modern architecture or in aerospace.

Lithium also has other applications such as in psychiatric medication as lithium salts, used to remove oxygen and other gases in the manufacture of stainless steel, flux powder, and in lubrication grease used in vehicles, wheel bearings, industrial equipment and much more (due to its heat resistance and water tolerance). Lithium has a whole host of uses and the future looks like it will need more of it for its primary use in batteries.

The dawn of the 21st century brought about an unprecedented surge in lithium demand, primarily fueled by the global shift towards renewable energy and electric vehicles (EVs). The early 2000s marked the beginning of a significant shift towards electric vehicles, with companies like Tesla spearheading the development of high-performance EVs. Lithium-ion batteries became the preferred choice for EV manufacturers due to their high energy density and efficiency. This transition significantly boosted lithium demand, leading to increased mining activities and investments in lithium extraction technologies.

Largest Sources and Producers of Lithium

One of the major risks facing the lithium mining companies is the market volatility in the lithium spot prices. Plenty of lithium supply has come online in recent years, which brings into consideration the possible oversupply of lithium to the market which can cause prices to fall or rise abruptly.

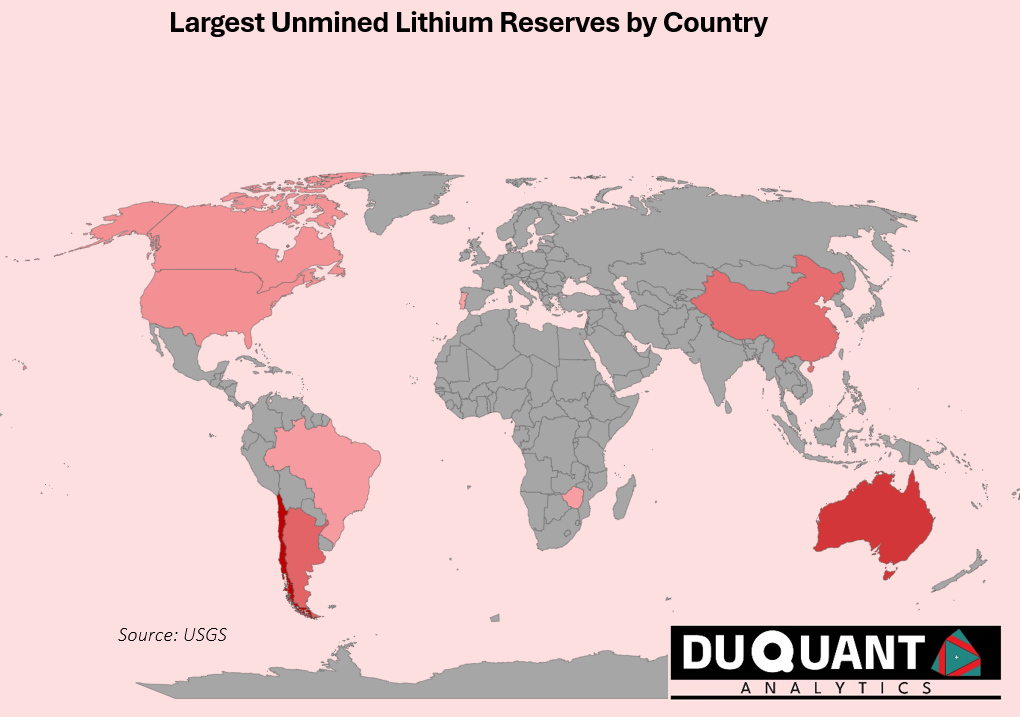

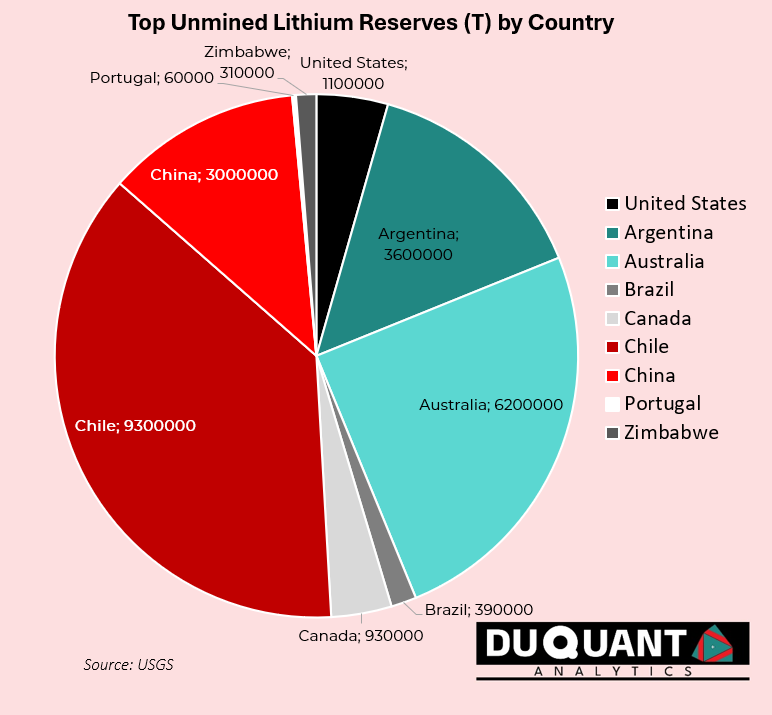

Lithium is found in many places around the world and according to the 2024 US Geological Survey (USGS), global lithium reserves stand at 28,000 Kilo tons (Kt/1000t) with the largest reserves being Chile (9,300 Kt), Australia (6,200 Kt), Argentina (3,600 Kt) and China (3,000 Kt). The remainder of the world makes up only 2790 Kt (or 21%).

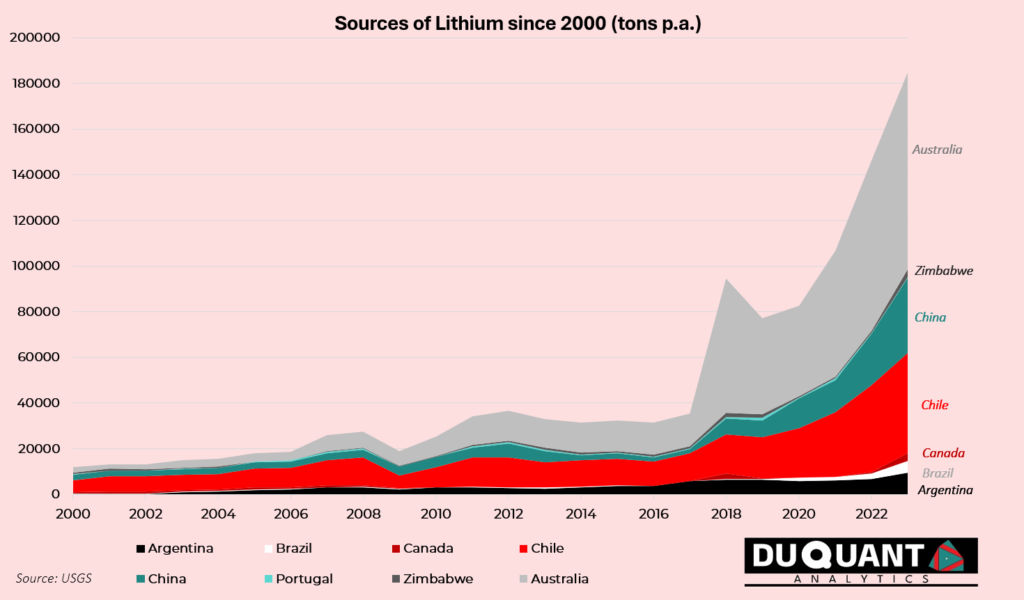

Lithium mine production since 2017 has increase over 400% 2023, from 35,300 to 180,000 tons. Majority of this increase can be attributed to Australia. In terms of total annual mine production, since 2000 approximately 44% of Lithium came from Australia, followed by Chile (30%), China (14%), and Argentina (7%). The rest of the world only makes up 12%, coming from Zimbabwe, Portugal, Canada, Brazil and USA.

Note that figures on the production from USA are withheld from the United States Geological Survey reports, but it’s estimated that USA produced 5000 tons in 2022 (or 3% of 2022 total), and imported 19,000 tons. Based on USA reserves and their relatively small production, indicates that USA could be underutilizing their own Lithium deposits and importing instead. Global reserves on lithium are large, with Chile and Australia being the largest.

At current mine production rates and reserves, the world has plenty of lithium with c.155.56 years left of mining on existing reserves. The price volatility on lithium also increases risks of mining. The rapid increase in production since 2017 saw lithium prices fall from around CNY 150,000/t in 2017, down to a low of around CNY 35,265/t in 2020. During 2021 lithium prices boomed and went up to a high of c.600,000/t in 2022 (low interest rate quantitative easing period). Lithium currently trades at around CNY 95,000/t in 2024.

The Remarkable History of Lithium

Lithium, a metal now well known for its place in modern technology and energy storage. The history of this light metal is a relatively recent but fascinating history that has profoundly impacted the world. Lithium mining began in the early 19th century with its discovery in a mineral known as petalite by the Brazilian chemist José Bonifácio de Andrada e Silva in 1800. However, it wasn’t until 1817 that the Swedish chemist Johan August Arfvedson identified the presence of a new element in petalite, naming it lithium, derived from “lithos,” the Greek word for stone. For a great part of the 19th century, science has been curious about lithium. It was isolated by William Thomas Brande and Sir Humphry Davy through electrolysis of lithium oxide in 1821, yet its practical applications were limited at the time. The metal’s potential began to be recognized towards the end of the century, particularly in the field of psychiatry, where lithium salts were used to treat mental health disorders. The early 20th century saw the first commercial production of lithium, primarily for use in high-temperature resistance grease for military applications during World War II. The unique properties of lithium, such as its high electrochemical potential and low atomic mass, also made it a valuable component in aircraft and submarine batteries.

The most transformative period for lithium began in the mid-20th century with the development of the lithium-ion battery. The groundwork was laid by various scientific advancements, culminating in the 1970s when researchers began exploring lithium’s potential in rechargeable batteries. The first commercially viable lithium-ion battery was developed by Sony and Asahi Kasei in 1991, revolutionizing the electronics industry. This breakthrough was driven by the need for more efficient and long-lasting power sources for the burgeoning market of portable electronics, such as laptops and mobile phones. Lithium-ion batteries offered significant advantages over previous battery technologies, including higher energy density, longer life cycles, and reduced weight. The late 20th century witnessed a surge in lithium demand, driven by the proliferation of consumer electronics. Lithium’s importance expanded beyond batteries to include applications in pharmaceuticals, glass and ceramics, and lubricants. The metal’s versatility and superior properties made it an indispensable material in various industries.

Lithium-ion batteries have become the cornerstone of energy storage systems, powering everything from smartphones to electric cars. This era marked the beginning of what is often referred to as the “Lithium Boom.” Significant lithium deposits were discovered worldwide, particularly in the “Lithium Triangle” of South America, which includes parts of Argentina, Bolivia, and Chile. This region became a powerhouse in lithium production, with its vast salt flats (salares) containing some of the highest concentrations of lithium brine in the world. The Salar de Atacama in Chile, the Salar de Uyuni in Bolivia, and the Salar del Hombre Muerto in Argentina emerged as key sites, transforming the global lithium market. In Australia, the discovery of substantial hard rock lithium deposits in Western Australia, particularly at the Greenbushes mine, further solidified the country’s position as a leading lithium producer. The United States also saw renewed interest in domestic lithium production, with significant deposits identified in Nevada’s Clayton Valley and other regions.

The 2008 Global Financial Crisis highlighted the need for more sustainable and resilient energy sources. Governments and corporations alike began investing heavily in renewable energy infrastructure, further driving lithium demand. This period saw significant advancements in battery technology and a surge in the production of lithium-ion batteries for various applications. The 2010s witnessed remarkable advancements in lithium extraction and battery technology. New methods, such as direct lithium extraction (DLE), aimed at increasing efficiency and reducing environmental impact, began to emerge. Lithium production soared to meet the growing demand from the EV and energy storage sectors.

The 2020s have so far been characterized by an accelerated transition towards green energy and the electrification of transportation. Governments worldwide have implemented policies to phase out internal combustion engines and promote EV adoption. This shift has placed unprecedented pressure on lithium producers to scale up production and secure stable supply chains. As seens in previous mine production charts, lithium production has increase 4x since 2017. With the rapid expansion of the lithium industry, environmental concerns have also come to the forefront. The extraction of lithium, particularly from brine, can have significant ecological impacts, including water depletion and habitat disruption. The industry has had to adapt by implementing more sustainable practices and investing in technologies to minimize environmental harm.

As the world continues to transition towards renewable energy and electrification, lithium’s importance is set to grow exponentially. The metal’s superior properties make it indispensable for the next generation of energy storage solutions, including solid-state batteries and advanced EV technologies. From its humble beginnings as a scientific curiosity to its current status as a critical component of modern technology, lithium’s journey is a testament to human ingenuity and the relentless pursuit of progress.

Download This Post in PDF

RESEARCH DISCLOSURE

Purpose: DUQUANT Analytics provides research notes and newsletters for market insights, analysis, informational, educational, and research purposes only. We adhere to the CFA Institute’s Code of Ethics and Standards of Professional Conduct which includes maintaining the highest standards of integrity, transparency and professionalism in all research activities. We strive to ensure that our investment analysis and actions remain unbiased and focused on delivering accurate information based on available knowledge at the time of release. We follow industry accepted methodologies for conducting due diligence and conduct our analysis on a reasonable basis.

Investor Responsibility and Limitation of Liability: This content does not constitute a recommendation to buy or sell any securities. It is essential to understand the nature of our research, which is for educational and informative purposes. It is imperative to conduct your own due diligence and research prior to making any investment. DUQUANT Analytics is not liable for any losses incurred from using our research. Information released is believed to be reliable, but not guaranteed for accuracy or completeness. It is also important to note that past performance is not reflective of future performance.

Potential Conflict of Interest: Personal Investments: Members of DUQUANT Analytics may hold positions in some of the assets or securities mentioned in our research notes and newsletters. This includes equities, bonds, commodities and other financial instruments. Despite any personal investments, our research is conducted with the highest level of integrity, independence and objectivity. We strive to ensure that our analysis remains unbiased by focusing on accurate, public and provable information and secondary data as it is released or becomes public.

Conclusion: DUQUANT Analytics is committed to providing high-quality research and insights to our readers. However, it is essential for investors to take responsibility for their own investment decisions and to understand the inherent risks involve, especially in mining which carries more risk than traditional assets. We encourage you to consult with a qualified financial advisor and to perform thorough research before making any investments.

Thank you for reading this disclosure note. We value your trust and strive to maintain the highest standards of integrity in all our research activities.