Navigating Biofuel

Did you know that the United States and Brazil dominate global biofuel production, but their strategies couldn’t be more different?

Scientific Properties of Biofuel

Biofuels are renewable energy sources derived from organic materials, offering a sustainable alternative to fossil fuels. Their key properties include lower carbon emissions, biodegradability, and compatibility with existing engine technologies when blended with conventional fuels. Biofuels like ethanol and biodiesel are distinct in their production and application. Ethanol is produced primarily from fermenting crops such as corn or sugarcane, while biodiesel is derived from vegetable oils, animal fats, or recycled cooking grease. Ethanol is an alcohol-based fuel typically blended with gasoline to improve combustion efficiency and reduce emissions.

Conversely, biodiesel is a fatty acid methyl ester (FAME) designed for use in diesel engines, often blended with traditional diesel to enhance lubrication and reduce sulphur content. Despite their shared benefits, the difference lies in their chemical structures and production methods, which influence their specific applications and environmental impact. Ethanol’s oxygen content helps improve engine performance and reduce greenhouse gases, while biodiesel’s high energy density and lubricating properties make it particularly suited for heavy-duty diesel engines.

Uses and Future Applications

Biofuels are increasingly being used in transportation, power generation, and even aviation, reflecting their versatility as renewable energy sources. Ethanol-gasoline blends are common in passenger vehicles, particularly in countries like the United States and Brazil, where government mandates drive their widespread adoption. Biodiesel, often blended with petroleum diesel, powers trucks, buses, and marine vessels, offering an eco-friendly alternative to traditional fuels in sectors reliant on diesel engines. Additionally, biofuels are gaining traction in aviation through the development of sustainable aviation fuels (SAFs) that can significantly reduce the carbon footprint of air travel.

The growth potential for biofuels is immense, driven by rising global energy demands, concerns over climate change, and governmental policies promoting renewable energy. For instance, initiatives like the European Union’s Renewable Energy Directive and the U.S. Renewable Fuel Standard aim to increase the share of biofuels in energy consumption. The development of advanced biofuels from non-food feedstocks, such as agricultural residues and algae, further expands the potential by reducing competition with food production and increasing yield efficiency. These innovations promise to make biofuels a cornerstone of the global energy transition.

The main demand for biofuels comes from the transportation sector, accounting for the largest share of consumption. Emerging economies in Asia and Africa are also witnessing increasing demand as they seek cleaner energy solutions to support their rapid urbanisation and industrialisation. Furthermore, international agreements like the Paris Accord and growing investor interest in green energy are bolstering the development and adoption of biofuels. As technology evolves and production costs decline, biofuels are poised to play a critical role in meeting global energy needs while addressing environmental sustainability.

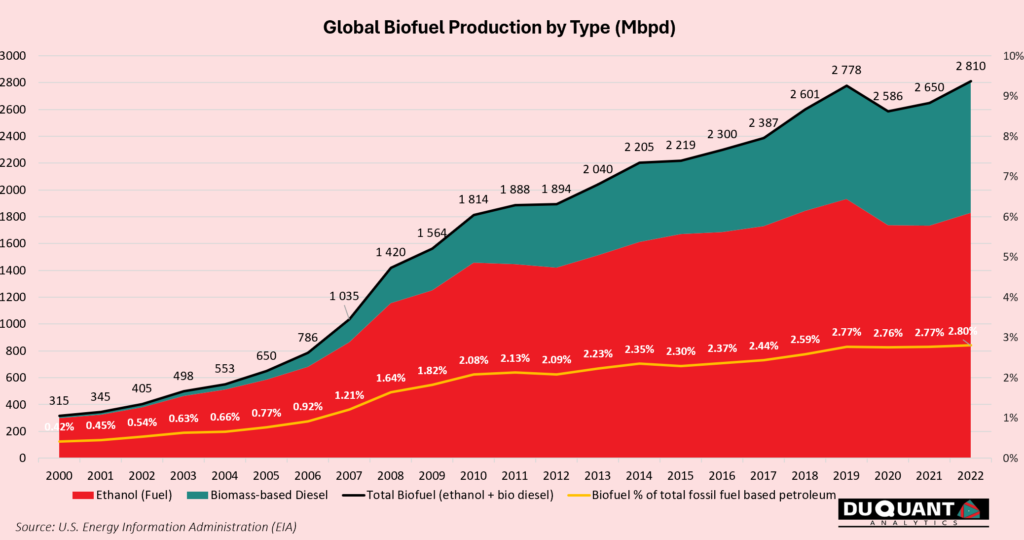

The global biofuel market has grown to around 2,810 thousand barrels per day (Mbdp) and makes up roughly ~2.8% of global fossil fuel derived petroleum products, – which is close to 102,068 Mbpd in 2023. Around ~65% of all biofuel is ethanol based, while the remaining ~35% is biodiesel based biofuel.

Largest Sources and Producers of Biofuel

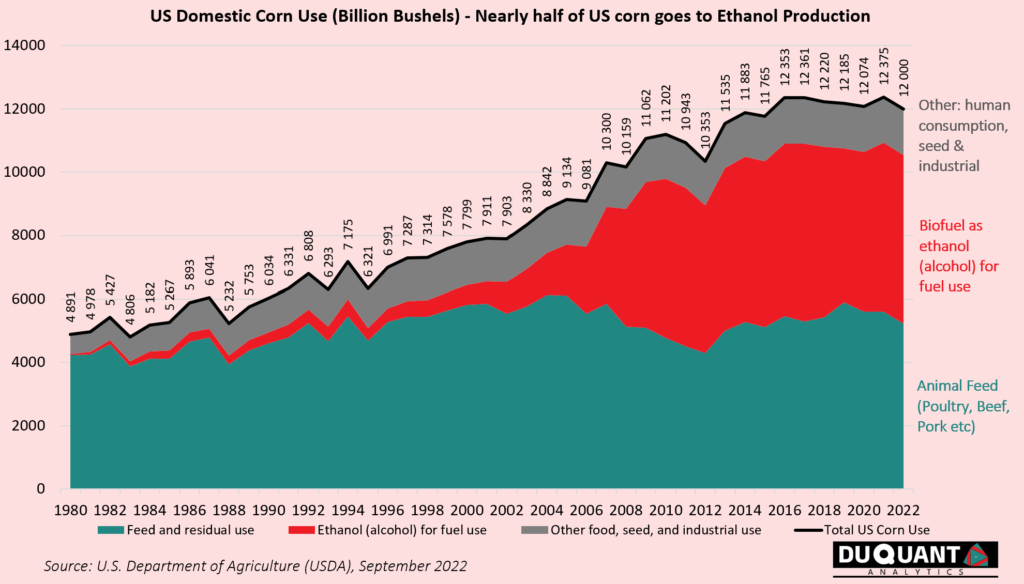

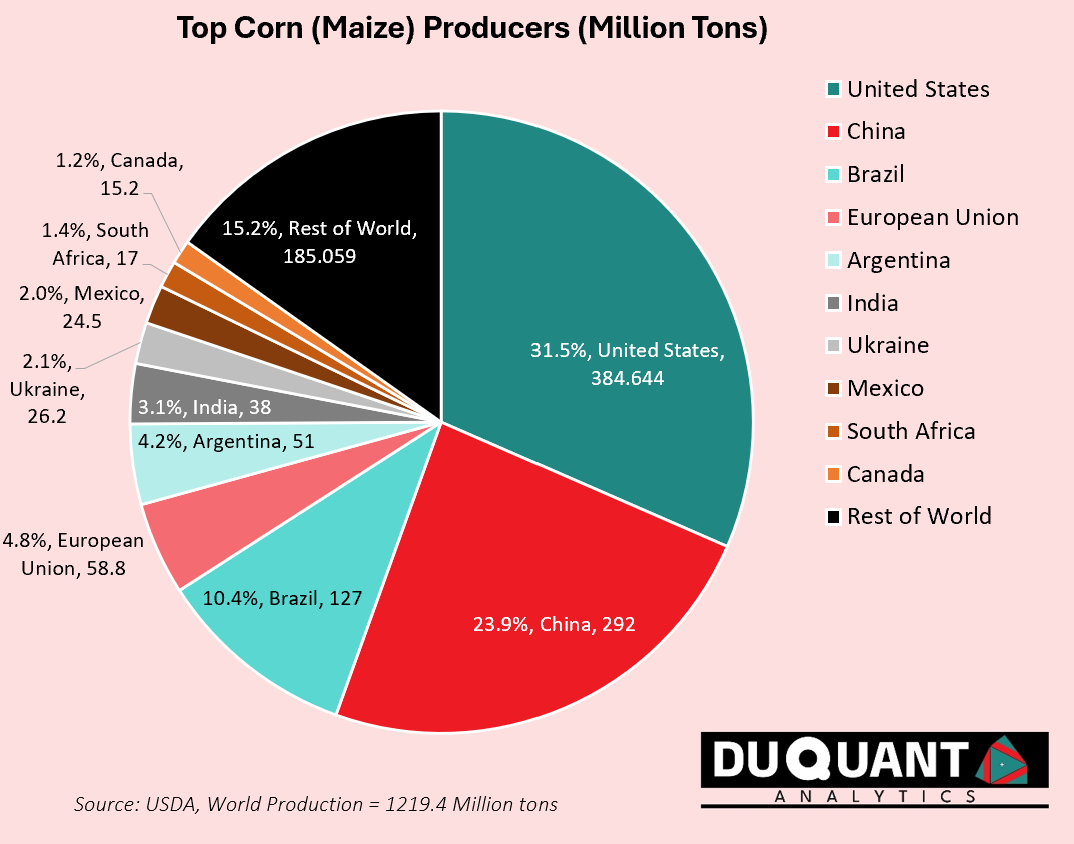

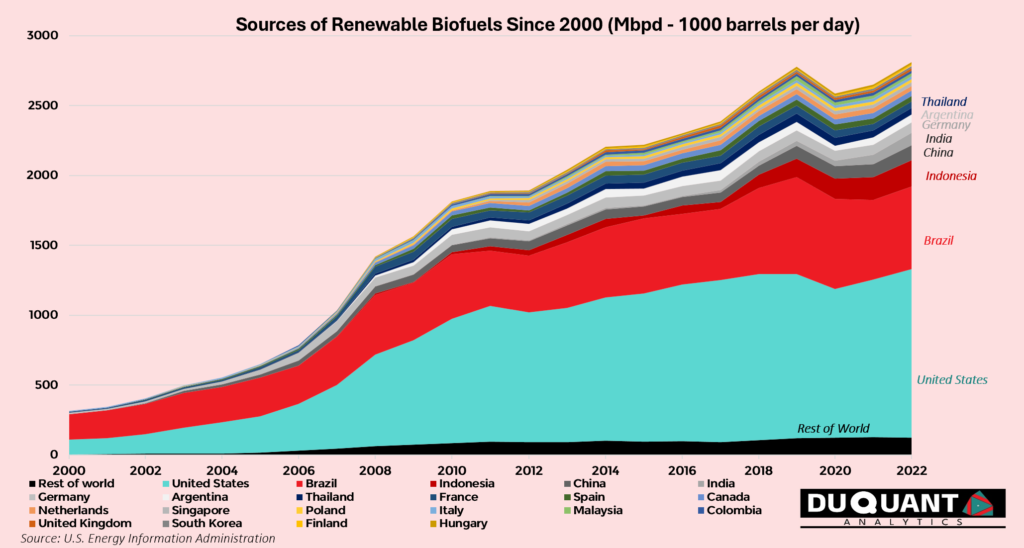

The largest producers of biofuel globally are the United States, Brazil, and the European Union, and Indonesia, each leveraging unique natural and economic advantages to dominate the market. Together, these regions account for the majority of biofuel production, with ethanol and biodiesel as the primary fuels. Biofuel production worldwide largely depends on the countries ability to produce excess corn (maize), and thereby is dependent on 1) a robust agricultural sector, and 2) ideal land and weather conditions for growing corn at large scale. The U.S. leads global biofuel production, primarily driven by its vast ethanol output. Corn is the backbone of the U.S. ethanol industry, with nearly half of the country’s corn crop dedicated to biofuel production.

The U.S. has several natural advantages, including fertile land, advanced agricultural practices, and robust infrastructure for transport and processing. Additionally, federal policies such as the Renewable Fuel Standard (RFS) and tax incentives have spurred investment in biofuels. The country’s advanced technology in developing cellulosic ethanol and algae-based biofuels positions it as a leader in next-generation biofuels. This leaves only a few countries with a natural advantage at producing corn, summarized in the diagram below:

The United States focuses on diversifying its energy mix to enhance energy independence, reduce greenhouse gas emissions, and support rural economic development. As the largest producer of biofuels globally, the U.S. has centered its biofuel strategy on ethanol derived from corn and biodiesel from soybeans. Biofuels are integral to the U.S. strategy to reduce greenhouse gas emissions and transition to cleaner energy sources. The industry also supports rural economies by creating jobs and providing a stable market for farmers, – one of the the backbones of the US economy.

China, despite producing approximately 24% of the world’s corn, remains a relatively minor player in global biofuel production. Several factors explain this paradox. China’s vast population of over 1.4 billion drives a policy focus on food security. Corn is a staple in animal feed and an essential component of food production, making it critical to the country’s agricultural stability and thereby majority of China’s corn is allocated for animal feed to supply growing demand for meat and food security. Diverting significant quantities of corn toward biofuel production could strain food supplies and drive up prices, creating domestic instability. This prioritisation limits the expansion of corn-based ethanol production. China’s energy strategy historically focused on importing cheap oil and developing coal-based energy to meet its needs. While biofuels align with global decarbonisation trends, they currently play a minor role in China’s overall energy portfolio. The nation has instead invested heavily in electric vehicles (EVs) and renewable energy sources, such as wind and solar, as part of its strategy to transition away from fossil fuels.

Brazil is the second-largest producer, with ethanol derived primarily from sugarcane. Its tropical climate and long growing season allow sugarcane to thrive, yielding higher ethanol output per hectare compared to corn. Brazil’s extensive flex-fuel vehicle market, capable of running on pure ethanol or blends, ensures strong domestic demand. Additionally, the country’s Proálcool Programme, initiated in the 1970s, set the foundation for large-scale biofuel production. Brazil’s potential lies in expanding sugarcane cultivation and improving production efficiency, particularly through bagasse-based (sugarcane residue) biofuels. Sugarcane yields more ethanol per hectare than corn, thus making it highly efficient for biofuel feedstock. Brazil’s energy strategy revolves around leveraging its abundant natural resources to achieve energy security, reduce dependence on fossil fuels, and minimize greenhouse gas emissions. This strategy has made Brazil the second-largest biofuel producer globally, primarily due to its ethanol production from sugarcane.

The EU (combined) is also a leader in biodiesel production, with countries like Germany, France, and Spain at the forefront. The region’s focus on reducing greenhouse gas emissions and meeting renewable energy targets drives the demand for biodiesel. The EU benefits from a strong agricultural base, particularly in oilseeds like rapeseed and sunflower, which are key biodiesel feedstocks. Policies such as the Renewable Energy Directive (RED) promote biofuel use, and the EU is exploring advanced biofuels from non-food feedstocks to overcome land-use concerns.

The future of biofuel production lies in technological innovation, diversification of feedstocks, and the expanding global market for renewable energy. In the U.S., advancements in cellulosic ethanol production from agricultural residues and dedicated energy crops offer the potential to significantly increase yields without competing with food supply. Brazil has room to expand sugarcane cultivation and improve productivity through genetic modification and better farming techniques.

Emerging markets in Asia and Africa, particularly India, China, and sub-Saharan countries, are poised to play a significant role in the future biofuel market. These regions have vast agricultural potential and are exploring biofuels to reduce dependence on imported fossil fuels while addressing rural development and energy access issues. Innovations in biofuel technologies, such as algae-based biodiesel and synthetic biofuels, promise to overcome current limitations and enhance scalability.

Moreover, the aviation sector’s increasing interest in sustainable aviation fuels (SAFs) could drive a new wave of demand for biofuels. The global commitment to decarbonization, paired with increasing pressure to achieve energy independence, ensures that biofuels will remain a critical component of the renewable energy landscape, growing in production, efficiency, and geographic diversity.

The Remarkable History of Biofuel

Biofuel’s history is as old as the internal combustion engine itself, with roots tracing back to the 19th century when inventors like Nikolaus Otto and Rudolf Diesel envisioned engines running on renewable resources. Rudolf Diesel’s early engines were demonstrated using peanut oil, while Henry Ford famously designed the Model T to run on ethanol. Ethanol, an alcohol-based fuel, has ancient origins, being distilled for uses in beverages and as a combustible material for thousands of years. Its potential as a fuel became prominent in the early 20th century as industries explored alternatives to petroleum.

The rise of petroleum-based fuels after World War I curtailed biofuel’s development due to the availability and low cost of crude oil. However, ethanol resurfaced during periods of fuel shortages, such as the 1930s Great Depression and World War II, when it was blended with gasoline as a “gasohol” to stretch petroleum supplies. After the war, biofuels again fell into obscurity, but the 1970s energy crises reignited interest, particularly in the United States, as oil prices soared and concerns over energy security grew. Federal policies like the Energy Tax Act of 1978 incentivized ethanol production from surplus crops, particularly corn, laying the groundwork for the modern biofuel industry.

Ethanol fuel became a cornerstone of the biofuel industry, driven by environmental awareness and economic opportunity. In the late 20th century, efforts to reduce harmful emissions spurred the adoption of ethanol as a cleaner-burning additive to gasoline. The introduction of reformulated gasoline under the Clean Air Act Amendments of 1990 further propelled ethanol demand, as it replaced toxic additives like MTBE (methyl tert-butyl ether). By the early 2000s, the U.S. government’s Renewable Fuel Standard (RFS) mandated increasing biofuel volumes in transportation fuel, dramatically expanding ethanol’s market share. Today, biofuels form a significant part of the U.S. energy portfolio, with ethanol making up nearly half of the country’s corn usage.

The ethanol industry, primarily based on corn as a feedstock, has reshaped American agriculture, creating a symbiotic relationship between farmers and the renewable energy sector. Similarly, biodiesel production, supported by soybean oil and recycled fats, has grown alongside ethanol, diversifying biofuel options for various sectors. Technological advances, such as cellulosic ethanol and algae-based biodiesel, have further positioned biofuels as a solution to reducing dependence on fossil fuels and mitigating climate change.

The alcohol-based nature of biofuels connects them to a long lineage of human innovation, where ethanol was historically used for lighting lamps and powering machinery. The transformation of ethanol from a staple of early distillation processes to a cornerstone of modern energy systems highlights its enduring utility. Throughout history, biofuels have adapted to meet societal needs, from local agricultural surpluses to global energy challenges. Today’s robust biofuel market exemplifies how traditional techniques, such as fermentation, can integrate with modern technology to address some of the world’s most pressing energy and environmental challenges.

Download This Post in PDF

RESEARCH DISCLOSURE

Purpose: DUQUANT ANALYTICS (PTY) LTD provides research notes and newsletters for market insights, analysis, informational, educational, and research purposes only. We adhere to the CFA Institute’s Code of Ethics and Standards of Professional Conduct which includes maintaining the highest standards of integrity, transparency and professionalism in all research activities. We strive to ensure that our investment analysis and actions remain unbiased and focused on delivering accurate information based on available knowledge at the time of release. We follow industry accepted methodologies for conducting due diligence and conduct our analysis on a reasonable basis.

Investor Responsibility and Limitation of Liability: This content does not constitute a recommendation to buy or sell any securities. It is essential to understand the nature of our research, which is for educational and informative purposes. It is imperative to conduct your own due diligence and research prior to making any investment. DUQUANT ANALYTICS (PTY) LTD is not liable for any losses incurred from using our research. Information released is believed to be reliable, but not guaranteed for accuracy or completeness. It is also important to note that past performance is not reflective of future performance.

Potential Conflict of Interest: Personal Investments: Members of DUQUANT ANALYTICS (PTY) LTD may hold positions in some of the assets or securities mentioned in our research notes and newsletters. This includes equities, bonds, commodities and other financial instruments. Despite any personal investments, our research is conducted with the highest level of integrity, independence and objectivity. We strive to ensure that our analysis remains unbiased by focusing on accurate, public and provable information and secondary data as it is released or becomes public.

Conclusion: DUQUANT ANALYTICS (PTY) LTD is committed to providing high-quality research and insights to our readers. However, it is essential for investors to take responsibility for their own investment decisions and to understand the inherent risks involve, especially in mining which carries more risk than traditional assets. We encourage you to consult with a qualified financial advisor and to perform thorough research before making any investments.

Thank you for reading this disclosure note. We value your trust and strive to maintain the highest standards of integrity in all our research activities.