Harmony Gold Mining Company Ltd

NYSE:HMY or JSE:HAR

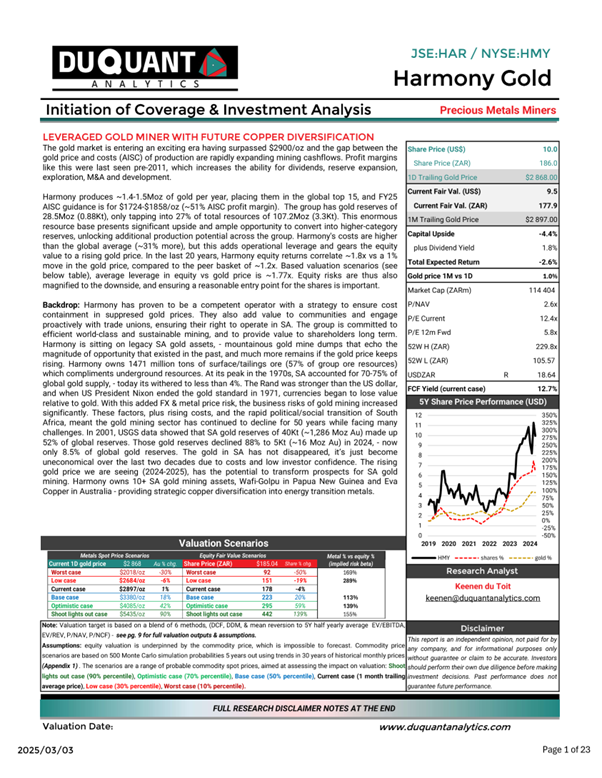

Equity Research on Harmony Gold

Initiation on Harmony Gold (JSE:HAR / NYSE:HMY)

Initiation on Harmony Gold (JSE:HAR / NYSE:HMY) The following equity research report aims to dive…

Business Overview

Harmony Gold Mining Company is a 74-year-old mining legacy and has positioned itself to leverage a rising gold price and extend its production base. Over the past two decades, the group has transformed from a high-cost, SA-focused deep-level gold producer into a more diversified mining company with complimentary lower AISC surface gold operations and future copper potential. The group has expanded its capabilities and reach through acquisitions, mine development, and exploration success. Harmony has also navigated significant industry challenges, low gold price environments, and regulatory Mining Charter reforms that reshaped SA’s mining sector. Through all this, they also managed to strengthen the reserve base, pursued strategic growth in copper and worked towards securing long-term sustainability. Harmony is a leading South African gold producer with a strong presence in both South Africa and Papua New Guinea (PNG) (see table below for country exposures). The company primarily focuses on deep-level underground mining, with additional open-pit and surface operations. Harmony is among the most prominent gold miners globally, known for operating some of the deepest and most technically challenging gold mines in the world.

The company’s core business includes gold ore mining and processing from underground, surface, and open pit. They are also involved in exploration & development, including advancing growth projects in both South Africa, PNG and Australia. Harmony conducts tailings retreatment at their surface operations and is able to profitably extract residual gold from historic mine dumps at a lower AISC than underground mining. Harmony also has copper Exposure at The Wafi-Golpu Project (in PNG), which provides diversification into copper production. Copper is one of the green energy transition metals poised to have significant growth in demand over the next 20 years.

Harmony is a global leading, sustainable gold mining company that delivers long-term value to stakeholders while contributing positively to the environment and society. And they strive to do this through safety, profitability and ensuring sustainable operations. They also aim to maintain high environmental and safety standards. They are growth and operational efficiency orientated with long-life assets which have the potential to deliver value to shareholders in a rising gold environment, as well as improve the lives of employees and the communities where they operate.

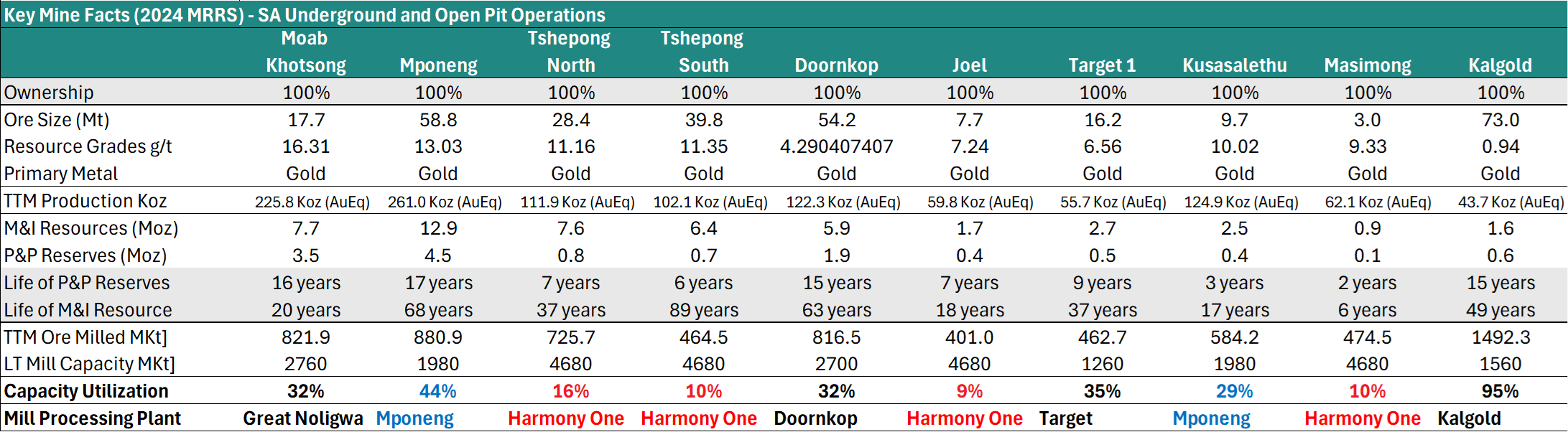

Segmental Overview 1: South Africa (~59% of M&I Gold Resources)

Harmony’s South African operations make up ~90% of current group gold production. Despite progress towards diversification into Papua New Guinea and Australia, Harmony will likely remain a core South African business well into the future.

South African Underground Operations (~45% P&P reserves, ~54% M&I resources)

Harmony Gold operates some of the most technically challenging underground gold mines in the world, particularly due to the extreme depth, seismicity, and geotechnical conditions of its South African operations. Underground gold mining operations made up around 72% of the groups production in the last 3 years, and ~77% of M&I resources, thereby these operations underpin majority of the groups value. As at FY24 the AISC for underground operations stood at $1610/oz.

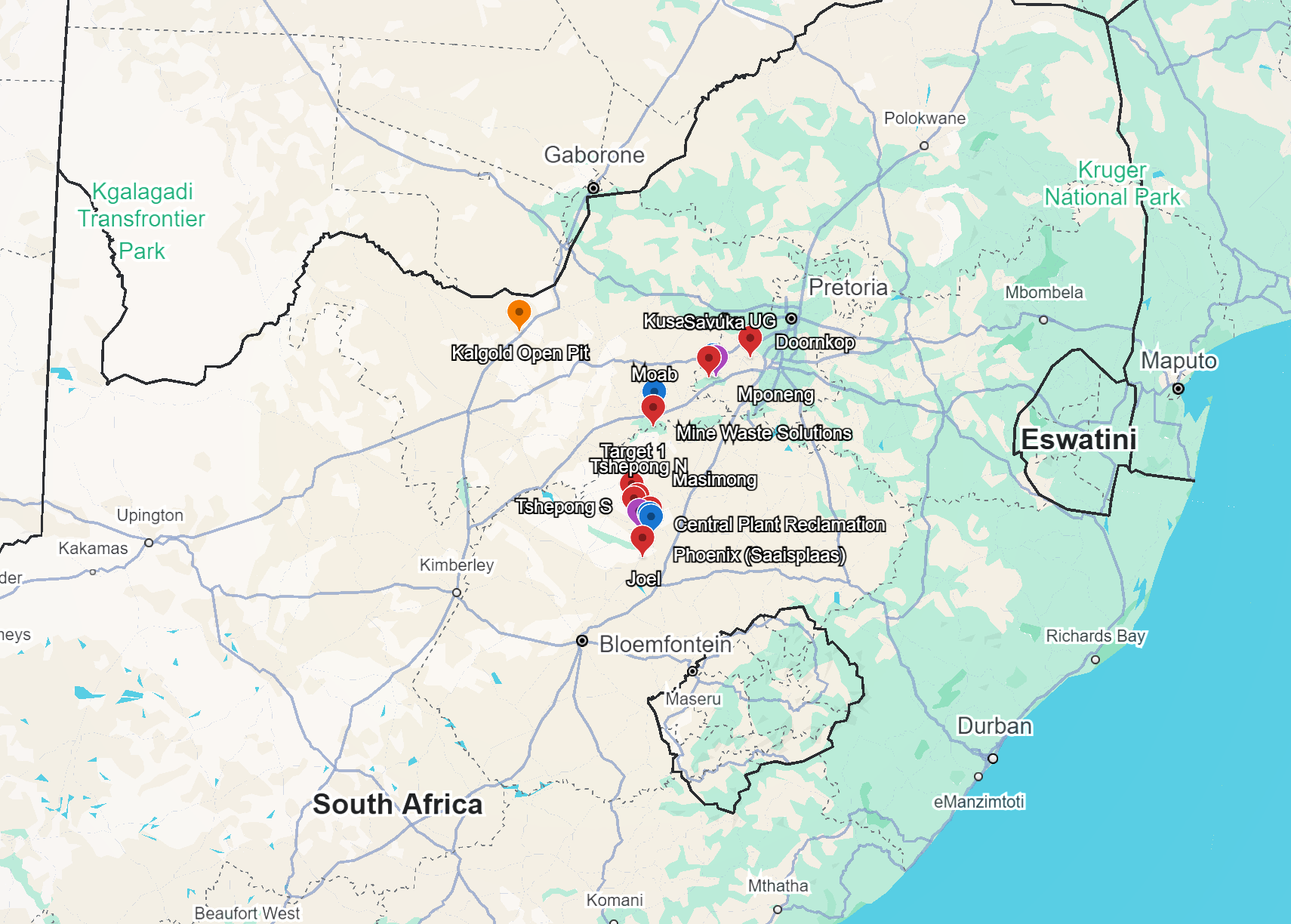

Map of Harmony’s South African Assets

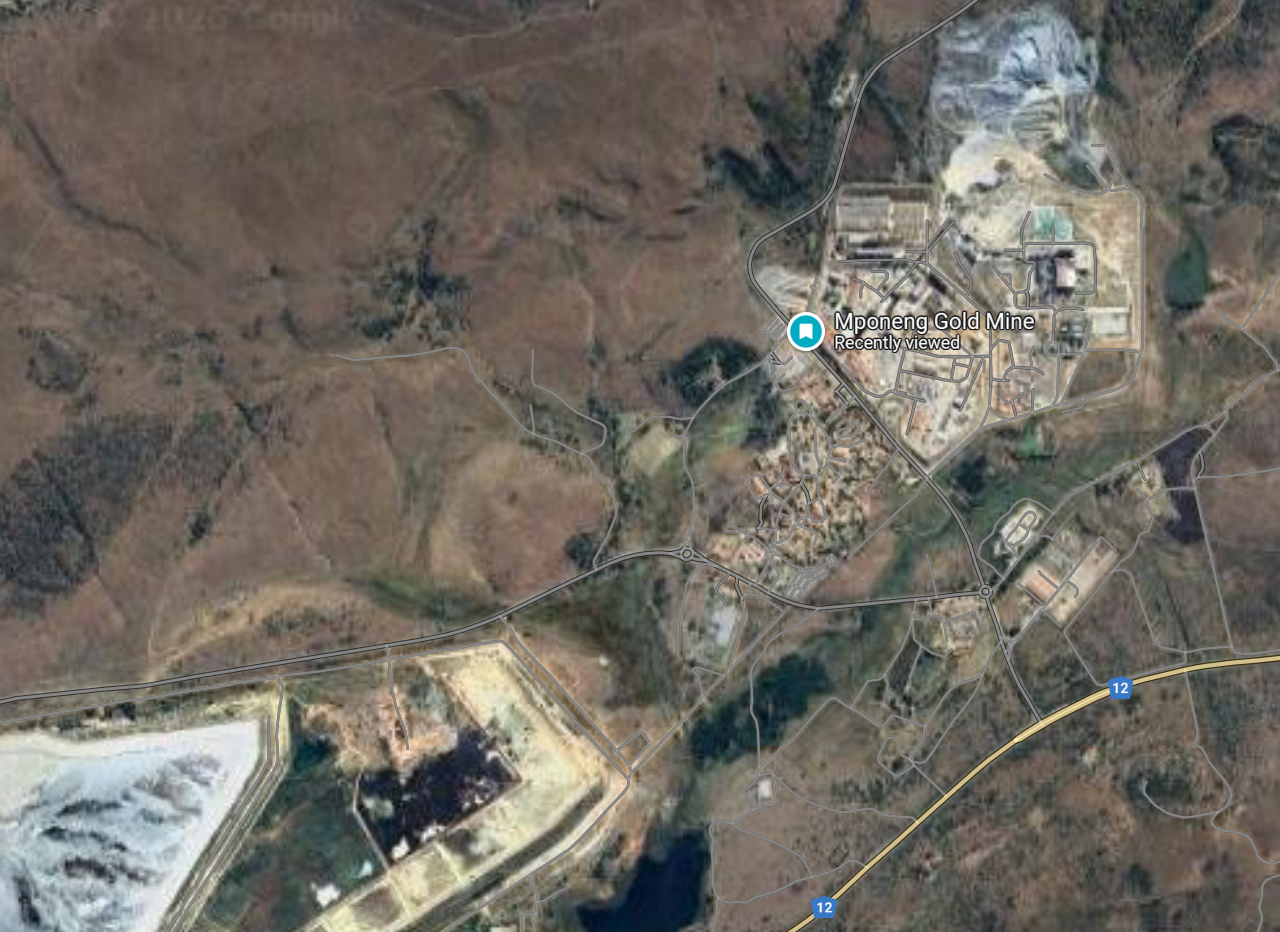

Mponeng Undeground Mine (~13% M&I AuEq resources)

~260koz gold p.a. and 20 year LOM @ AISC $1306/oz

Harmony Gold’s Mponeng mine, situated in the Witwatersrand Basin near Carletonville, South Africa, sets the record as the deepest gold mine in the world, reaching depths of over 4,000 metres and been in operation since 1986. Acquired from AngloGold Ashanti in 2020, Mponeng remains a high-grade, long life (20Y) operation with a rich mineral reserve base. Mining at such extreme depths presents unique challenges, including seismic activity and ventilation requirements, which Harmony has addressed through advanced engineering solutions. The mine plays a strategic role in Harmony’s portfolio, contributing significant ounces to production (~17% of group) while benefiting from processing and plant synergies with Harmony’s nearby Kusasalethu operations where ore is blended.

Tarkwa Aerial View

Mponeng Operations

Moab Khotsong Underground Gold Mine (~7.7% M&I AuEq resources)

~210koz gold p.a. and 20 year LOM @ AISC $1329/oz

Moab Khotsong, also acquired from AngloGold Ashanti in 2018, is a high-grade underground gold mine located in North West Province, South Africa. The mine includes the adjacent Great Noligwa operation and features some of the highest grades in Harmony’s portfolio. With a relatively deep mining depth of up to 3,100 metres, Moab Khotsong is an important contributor to Harmony’s overall gold production. The mine also offers uranium by-product potential, enhancing its economic profile. Continuous investment in infrastructure and efficiency improvements has been key to sustaining production at Moab Khotsong.

Moab Aerial View

Moab Operations

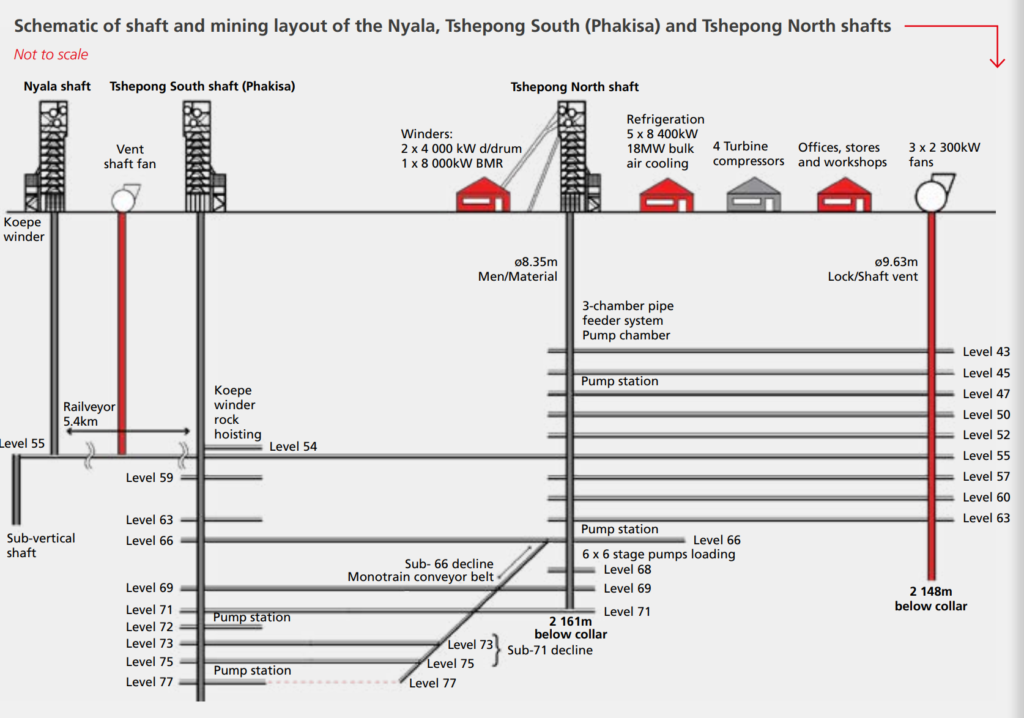

Tshepong Operations: (~14% M&I Gold Resources)

Harmony acquired the Tshepong operations AngloGold Ashanti Limited in 2003. The Tshepong operations are split into Tshepong North and Tshepong South, and located near Welkom in the Free State province of South Africa. Tshepong North is the older section, while Tshepong South was developed as an extension to improve operational flexibility and extend mine life. These underground operations produce around the same amount of gold and reach depths of around 2,200 metres and have undergone various optimisation strategies to enhance output and cost efficiency. Tshepong remains a vital component of Harmony’s South African production base.

Tshepong North Underground Gold Mine (~8% M&I AuEq resources)

~100-110koz gold p.a. and 7 year LOM @ AISC $1795/oz

Tshepong North is a mature deep-level underground mining operation (~2km deep) that primarily exploits the Basal Reef using conventional undercut mining, with the B Reef mined as a high-grade secondary source. Ore extracted is processed at the Harmony One plant, where gold is recovered through the cyanide leaching process. The workforce is around 3774 and grades are around 4.47g/t with a higher cost than at Tshepong South.

Tshepong South Underground Gold Mine (~6% M&I AuEq resources)

~100-110koz gold p.a. and 6 year LOM @ AISC $1667/oz

Tshepong South also mines the Basal Reef, and slightly deeper than Tshepong North at ~1.5km-2.3km depths. Grades at Tshepong South and higher than North and are around 6.73g/t. The workforce as at FY24 is made up of 3490 people. Rock is transported via a railveyor system to the Nyala shaft for hoisting to surface before processing at the Harmony One plant, where gold extraction also follows the cyanide leaching process.

Tshepong Operations Schematic: Screenshot from Harmony Gold Mineral Resources and Reserves Report 2024

Tshepong North Operations

Tshepong South (Phakisa) Operations

Doornkop Underground Gold Mine (~7.8% M&I resources)

~120koz gold p.a. and and 18 year LOM @ AISC $1716/oz

The Doornkop mine, located west of Johannesburg, is a single-shaft, deep-level long life operation extending to about 2,000 metres below surface. The mine primarily exploits the South Reef, known for its consistent grades ~4.3g/t. Doornkop is recognized for its modern mining infrastructure, including mechanized sections that improve efficiency and safety. Harmony continues to invest in Doornkop to sustain output and optimize costs, reinforcing its role as a key asset within the company’s South African portfolio.

Doornkop UG Aerial View

Doornkop Operations

Joel Underground Gold Mine (~1.9% M&I resources)

~58koz gold p.a. and 6 year LOM @ AISC $1927/oz

Joel is a conventional underground gold mine situated in the Free State, extracting ore from the Beatrix Reef at depths of up to 1,500 metres. The mine has a long operational history and contributes steadily to Harmony’s overall production. Joel’s reserve life is comparatively shorter than some of Harmony’s other assets, but the company continues to explore opportunities to enhance extraction efficiency and extend its viability. Gold grades are ~4.3g/t.

Joel UG Aerial View

Joel Operations

Target 1 Underground Gold Mine (~3.6% M&I resources)

~55koz gold p.a. and 5 year LOM @ AISC $2593/oz

Target 1 is an underground gold mine in the Free State province, operating at depths of around 2,200 metres. The mine has faced challenges in terms of production and costs, and is the highest cost operation for Hamrony, but the operation remains important with ore grades of ~4.1g/t currently and potential to increase to ~6g/t based on resource grades. Target 1 benefits from proximity to Harmony’s other Free State assets, allowing for processing, cost synergies and shared infrastructure.

Target 1 UG Aerial View

Target Operations Schematic from HAR MRRS FY24

Kusasalethu Underground Gold Mine (~3.3% M&I resources)

~120koz gold p.a. and 3 year LOM @ AISC $1761/oz

Kusasalethu, located near Carletonville, is one of Harmony’s deepest and most challenging mines, extending to depths of around 3,39km underground. This mine is known for its rich gold resources (3.1Moz) and high grades (MII resource grades at 10g/t as per FY24 MRRS). Kusasalethu has undergone various restructuring efforts in the past to enhance safety and efficiency. Despite its depth and seismic risks, the mine remains an important contributor to Harmony’s future, – at current production rates, total resources could be ~20+ years if they became economical. Yet reserves are only tapping into 0.4Moz (13% of the total resource). The workforce is currently 3968 people and FY24 grades were 6.58g/t.

Kusasalethu UG Gold Mine

Masimong Underground Mine (~1% M&I resources)

~60koz gold p.a. and 2 year LOM @ AISC $1866/oz

Masimong is a conventional underground gold mine in the Free State province, operating at moderate depths compared to Harmony’s other deep-level assets. The mine has a relatively lower-cost profile and remains a steady producer within Harmony’s portfolio. Continuous optimization efforts aim to sustain output and extend its operational life.

Masimong UG Aerial View

Masimong Operations

Kalgold Open Pit Mine (~2.3% M&I resources)

~49koz gold p.a. and 12 year LOM @ AISC $1579/oz

Kalgold is South Africa’s only open-pit gold mine in, located on the Kraaipan Greenstone Belt in the North West province of South Africa. The Kraaipan Belt consists of Archaean-aged greenstone rocks, which host gold mineralization similar similar to those hosting gold deposits in the Barberton and Zimbabwe cratons and other greenstone-hosted gold deposits worldwide. The belt is structurally complex and hosts banded iron formations, mafic-ultramafic sequences, and quartz veins that are known for their gold mineralization. Unlike its deep-level underground assets, Kalgold offers a lower-cost (and grade) mining approach and remains a steady contributor to Harmony’s production. The mine benefits from ongoing exploration efforts to expand its resource base and extend its mine life.

Kalgold Aerial View

Kalgold Open Pit

Source: Harmony Gold 2024 Mineral Reserves & Resources Statement & own DQA estimations

South African Surface Retreatment/Tailings Plants

Harmony’s surface retreatment plant contribute meaningfully to group gold production (~15%) and also do so at much lower AISC that the underground operations at $1171/oz (FY24; vs underground at $1610/oz).

Mine Waste Solutions (MWS) – Surface retreatment

~121koz gold p.a. and 15 year LOM @ AISC $1008/oz

Mine Waste Solutions is a tailings retreatment operation near Klerksdorp in North West province. It reprocesses low-grade material from tailing storage facilities scattered across the Vaal River and Stilfontein area to reduce the tailings footprint. The operation was acquired from AngloGold Ashanti Limited in October 2020. Harmony subsidiary, Chemwes, the owner of Mine Waste Solutions, has a contract with Franco-Nevada Barbados in terms of which Franco-Nevada is entitled to receive 25% of all the gold produced through Mine Waste Solutions.

MWS Aerial View

Mine Waste Solutions

Phoenix Surface Retreatment

~30koz gold p.a. and 4 year LOM @ AISC $1600/oz

Phoenix, a tailings retreatment operation in Virginia, Free State, retreats tailings from Harmony’s tailings storage facilities in the Free State region to extract any residual gold, using the Saaiplaats plant. It is 100% owned by the black economic empowerment company, Tswelopele Beneficiation Operation Proprietary Limited, of which Harmony is a 76% shareholder.

Phoenix Aerial View

Phoenix (Saaisplaats)

Central Plant Reclamation Surface Retreatment

~19.5koz gold p.a. and 11 year LOM @ AISC $1075/oz

CPR is a tailing retreatment plant situated in the Free State near Welkom. Originally built to process waste-rock dumps, it was converted into a tailings retreatment facility in FY17. The plant has a capacity of 3.6Mtp.

Central Plant Reclamations Plant

Savuka Surface Retreatment

~19.5koz gold p.a. and 3 year LOM @ AISC $1027/oz

Savuka plant is situated near the town of Carletonville and was acquired from AngloGold Ashanti Limited in October 2020. The plant originally treated both waste rock and tailings but was converted to a tailings treatment facility only in October 2021 when the milling section of the plant was decommissioned.

Savuka Dumps

Dumps Surface Retreatment

~55koz gold p.a. and 1 year LOM @ AISC $1349/oz

Production from processing surface-rock dumps, situated across Harmony’s Free State operations, depends entirely on the availability of spare mill capacity at the various operational plants. Waste and waste-rock dump deliveries to the Kusasalethu plant (near the border of Gauteng and North West provinces) supplement mining volumes to secure sufficient backfill to use as support in stoping areas. Waste-rock dumps near Orkney are treated at the Great Noligwa and Mispah plants. Milling of waste-rock dumps at the Doornkop plant, in Gauteng, began in FY18. Waste-rock dumps and tailings facilities acquired with Mponeng are treated at the Mponeng, Kusasalethu and Savuka plants.

Waste Rock Dumps

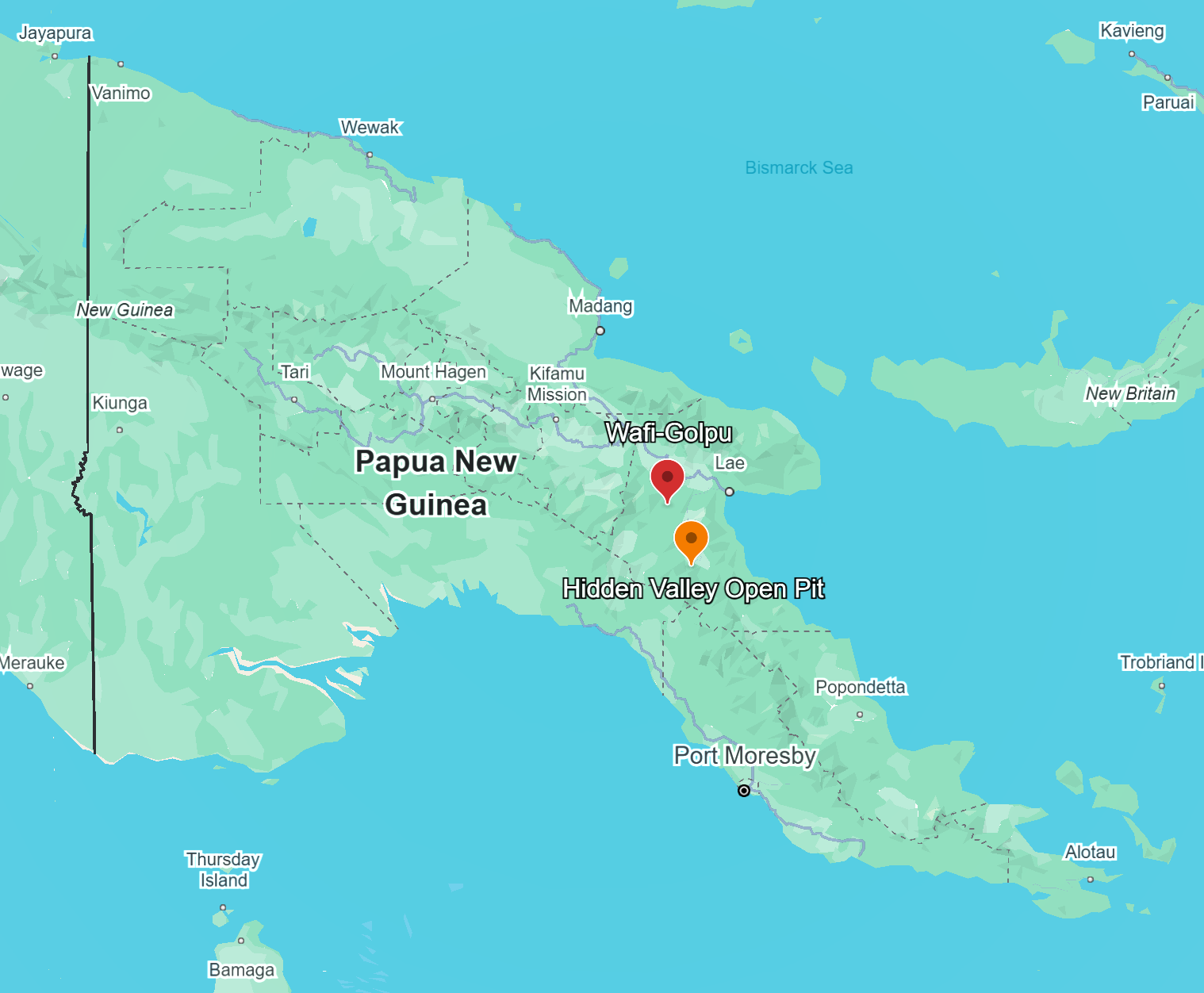

Segmental Overview 2: International Assets

Papau New Guinea (~44% of P&P GoldEq Reserves; 25% of M&I Resources)

Harmony Gold entered Papua New Guinea in 2004 via a joint venture with Newcrest Mining. It spent around $1 billion developing the Hidden Valley mine, which began production in 2009. In 2016, Harmony acquired Newcrest’s 50% stake.

Map: Harmony Gold PNG Locations

Hidden Valley Open Pit Mine (PNG)

~164koz gold p.a. and 5 year LOM @ AISC $1352/oz

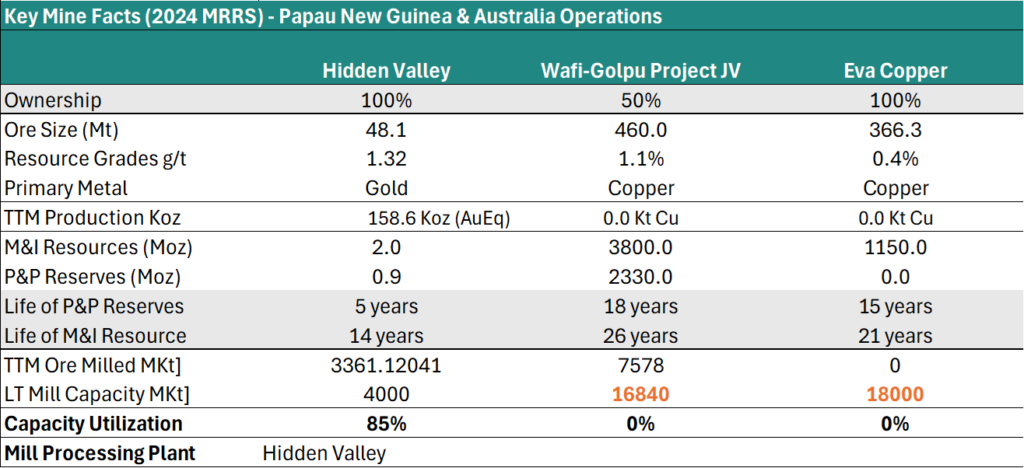

Hidden Valley, located in Morobe Province, PNG, is Harmony’s primary international gold asset. It is an open-pit mine producing both gold and silver, with operations supported by a modern processing plant. The mine benefits from its relatively lower-cost structure compared to Harmony’s South African deep-level mines. Harmony has continued investing in Hidden Valley to optimize output and extend its operational life. Crushed ore is transported 5.5 km via an overland conveyor to the Hidden Valley plant, where it undergoes two-stage crushing, semi-autogenous grinding, and separate silver and gold recovery using gravity, counter-current decantation/Merrill Crowe, and carbon-in-leach circuits.

Hidden Valley Aerial View

Hidden Valley Operations

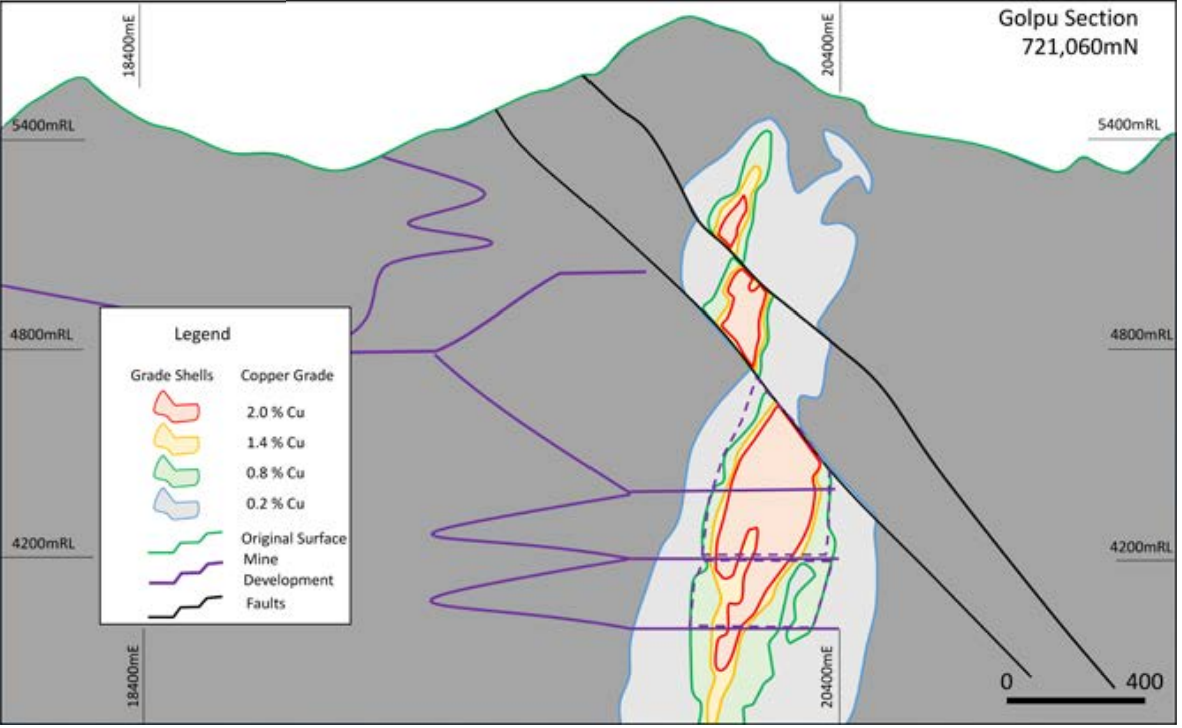

Wafi-Golpu Project (PNG)

The Wafi-Golpu Project, a 50:50 joint venture between Harmony and Newcrest Mining, is a world-class tier 1 copper-gold deposit in PNG, first identified in 1979. Resources: 13Moz gold, 4.3Mt Copper, 17Moz Silver and 82Mlb Molybdenum with LoM of 26 years – 4.3Mt CuEq or 35.1Moz AuEq. This project represents a major growth opportunity for Harmony, with significant reserves and a planned block cave mining approach that promises low-cost, long-life production. Wafi-Golpu is a key asset in Harmony’s growth & diversification strategy (copper), with a Framework MoU signed in April 2023 with Papua New Guinea to secure mining permits. Once approved, efforts will focus on project delivery and updating the feasibility study. The project requires storing ~316 million tons of tailings, but due to land constraints, seismic risks, and heavy rainfall, a deep-sea tailings disposal (DSTP) is proposed, using the region’s steep seabed to mitigate onshore risks.

Key facts from 2018 Updated DFS: Copper production of US$0.26/lb (US$2128/oz in gold terms). Maximum ore throughput of 14Mtpa and total operating cost of $17.33/t (PGK/USD weakened ~29% 2018-2025, so estimating ~$22.5/t in 2025 terms). Production over LoM of 4520Kt Cu and 7445 Koz Au. Initial CAPEX to commercial production ~$2.8bn, LoM CAPEX $5.4bn over LoM of ~28 years. NPV of ~2.5bn and real terms IRR of ~18.2%. First ore milled to be ~4.75 years from Special Mining Lease Grant.

Golpu Section from HAR MRRS 2024

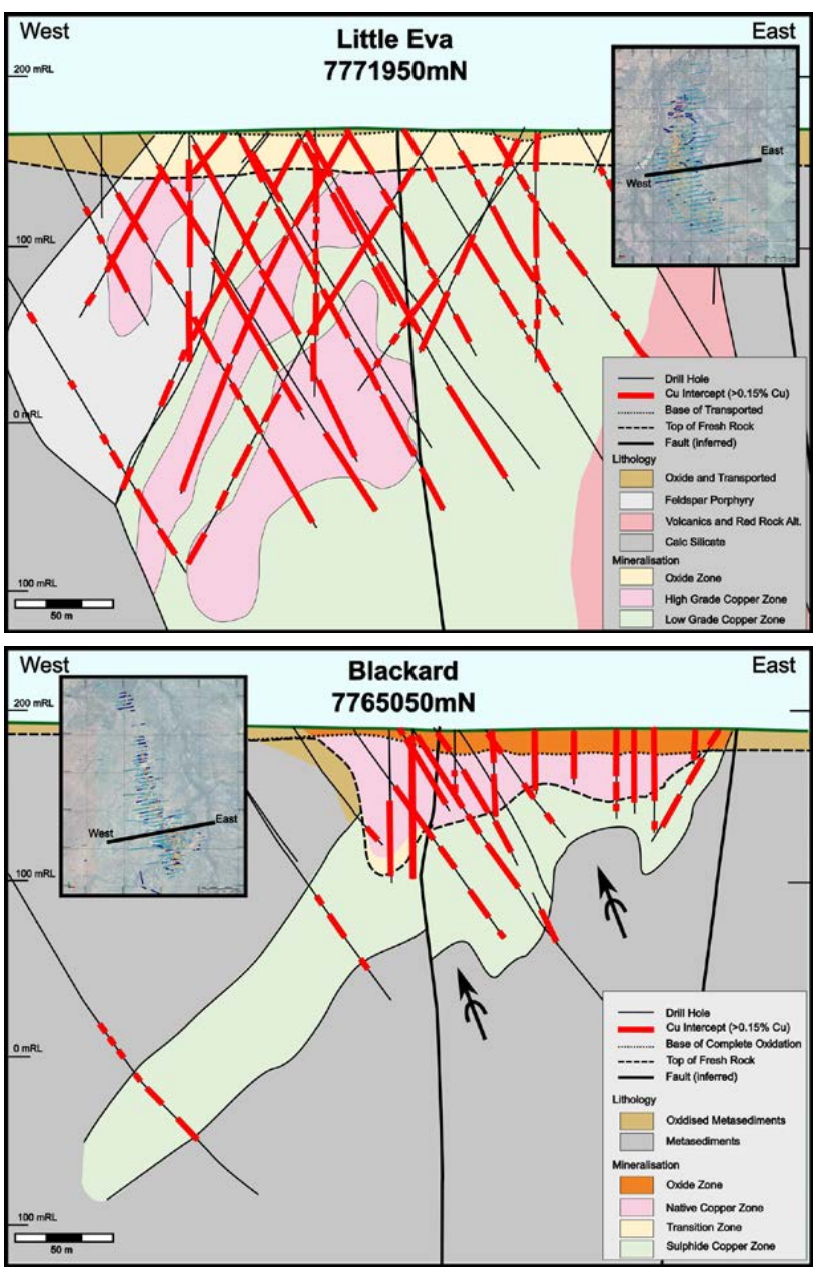

Australia (~5% of MII Au Equivalent Resources)

Eva Copper Project – Open Pit in Australia

Harmony successfully completed the acquisition of the Eva Copper project in 2022, marking its strategic entry into copper mining (resources 7.3Moz gold equivalent (0.44Moz of Gold, and 1.5Mt copper). The transaction, valued at US$170 million (~R3 billion), was financed through cash and revolving credit facilities. Reserves are to be declared once the feasibility study is concluded and the Eva Copper Project is developed. Harmony is targeting first production by FY28.

Key facts (2020 DFS): Eva copper presents further diversification into copper for Harmony, and over the LoM adds ~751Kt of recoverable Copper and 205Koz to the group. Harmony is busy concluding an updated feasibility study since 2024. The updated study proposes a larger copper concentrator with a milling throughput of up to 18 million tonnes per annum. The mine is expected to produce 50-60Kt of copper per year with a 15 year LoM, and AISC in the middle of the global cost curve. The 2020 DFS indicated Initial CAPEX spend of $443m, operating costs per ton milled of $11.39/t and LoM sustaining CAPEX of $0.02/lb, and a ~4.3% royalty.

St Ives Aerial View

Source: Harmony Gold 2024 Mineral Reserves & Resources Statement & own DQA estimations