DRDGOLD

JSE:DRD or NYSE:DRD

Equity Research on DRDGOLD

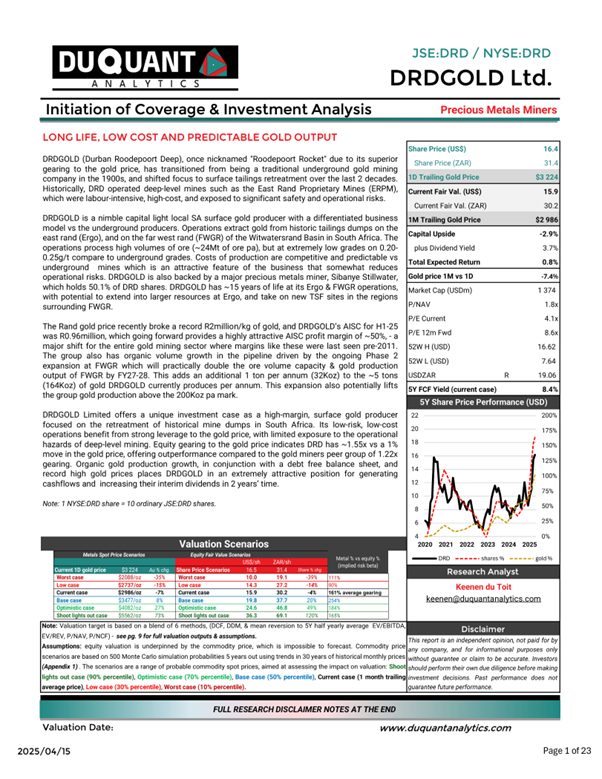

Initiation on DRDGOLD (JSE:DRD / NYSE:DRD)

Business Overview

DRDGOLD is a South African gold mining specialist involved in the reclamation and retreatment of surface and tailings dams to extract residual gold from historic gold mine dumps and dams surrounding Johannesburg. The grades are low, however, the business model is profitable given the feasibility of reprocessing residual ore at lower costs per ounce vs underground mining. The business model is not only highly profitable, but also capital light, and production output is predictable with significantly less risk than extracting gold from complex underground orebodies. DRDGOLD is also an unhedged gold producer providing optimal geared exposure to gold prices. DRD can remain undhedge as they do not need to sell forward due to their low cost advantage and solid balance sheet (debt free).

DRDGOLD produces ~164koz of gold per year, with proven and probable reserves to sustain production for ~15 years. As of H1-2025 the group has an AISC of $1670/oz (48% AISC profit margin at current $3224/oz gold price). DRDGOLD is well-positioned to maintain its production output, as well as grow its annual output by an additional ton per annum (32Koz) as the FWGR expansion is completed.

DRDGOLD processes residual gold from historic tailings surface facilities/dumps, and the operations are spread across two main regions (see map below), the Far West Gold Recoveries (FWGR), and the East Rand Gold Operations (ERGO). Tailings dumps are connected to the processing plants via slurry pipes where a re-treatment process is conducted with cyanide leaching process to dissolve remaining gold. Gold is then absorbed into activated carbon (caron in pulp), and from there the gold is stripped from the carbon and smelted into pure gold. The operations are low-grade, high ore volume, and predictable under normal operating conditions (i.e no major rolling blackouts experienced in SA 2021-2023).