Navigating Tin

Used as solder for electronics, renewable energy technologies, and electric vehicles, which makes tin critical for the growing tech and green energy sectors.

Scientific Properties of Tin

Tin (Sn), with an atomic number of 50 and an atomic mass of 118.71 u, is a silvery-white metal known for its distinctive yellowish tint and two unique allotropes. At temperatures below 13.2°C, it exists as brittle, nonmetallic α-tin (gray tin) with a diamond cubic structure, while at higher temperatures, it transforms into metallic β-tin (white tin) with a tetragonal crystal structure. This metal is highly malleable, ductile, and relatively soft, making it easy to shape and work with. Tin also resists corrosion well, forming a stable oxide layer in air, which makes it ideal for protective coatings, especially in steel cans. Its melting point of 231.93°C allows for easy alloy formation, particularly in combinations with copper to create bronze. Known for its characteristic “tin cry” when bent, caused by the breaking of its crystal structure, tin is also valued for its thermal and electrical conductivity, further cementing its role in soldering, electronics, and various other applications.

Uses and Future Applications

Tin is a versatile metal with applications across multiple industries. In electronics, it’s essential for soldering, connecting components in devices. Its corrosion resistance makes it valuable in tin plating, particularly for food cans and roofing materials. Tin is also a key component in alloys like bronze and pewter, adding strength and durability. In glass production, tin creates smooth surfaces through the float glass process. With growing demand in renewable energy and electric vehicles, tin is also being explored in lithium-ion batteries and solar panels. Its diverse uses, especially in tech and clean energy, make it a valuable asset for industries and investors alike.

Tin demand can be broken up into different markets, which are existing stable markets of ~360-380kt of metals and then the future growth markets which are being shaped by technological advancements, automation, the internet of things (IoT), 5G infrastructure, green renewable energy, and new applications in manufacturing and electronics.

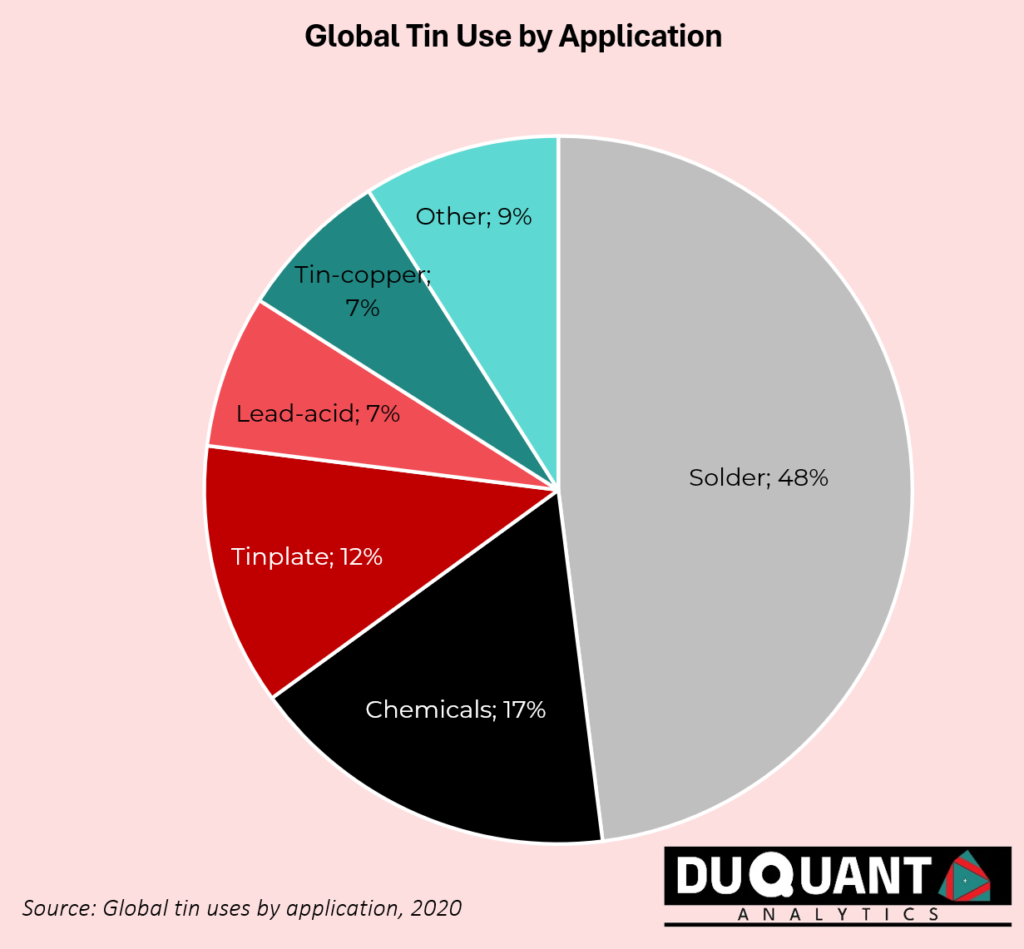

Current tin demand can be split into end use applications such as solder used in computer electronics and electric devices (~48% of demand), chemicals (17%), tinplating (12%) used in food and beverage cans, lead-acid batteries (7%), and alloys.

Tin is poised for growth across various high-demand sectors driven by technological advancements and renewable energy needs. In electronics, tin remains essential for soldering and is increasingly used in semiconductor packaging for chips and 5G infrastructure, as well as advanced IoT devices. Renewable energy also relies on tin, particularly in solar panels and potential battery technologies for storage solutions, including next-generation lithium-sulfur and solid-state batteries for electric vehicles (EVs). Additionally, tin-based compounds are explored for antimicrobial coatings and chemical catalysts, with growing interest in healthcare and packaging. The expansion of 3D printing in aerospace and automotive manufacturing presents another market, where tin’s role in specific alloys leverages its durability and anti-corrosive properties. These markets position tin as a critical component in emerging technology and sustainable energy solutions.

Largest Sources and Producers of Tin

Tin is a relatively small market, making up roughly 2% of the size of the copper market for perspective. Roughly ~360kt of tin is produced per annum, with around ~300kt from mines and 60kt from recycling. With a tin price of around $28,700/ton, this implied the size of the market is just over $10 billion per year, which is small but there are still opportunities for investment and long-term tailwinds driving demand.

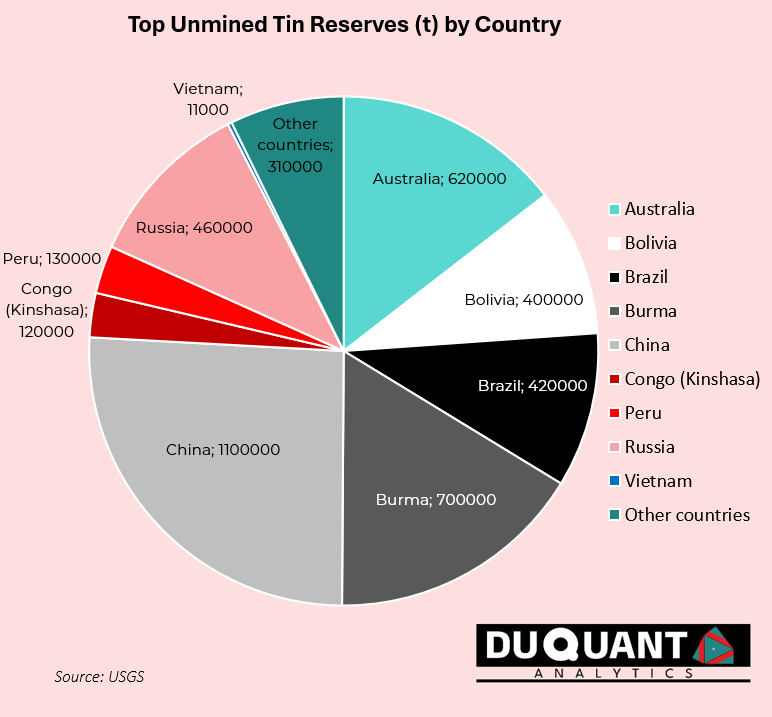

According to the 2024 US Geological Survey (USGS), global tin reserves are estimated to be around 4.3 million tons. China holds the largest reserves (1100Kt or 26%), followed by Burma (700Kt or 16%), Australia (620kt or 14%), Russia (460kt or 11%) and Brazil (420kt or 10%). While USGS does not disclose the size of Indonesia’s tin reserves, Indonesia has contributed a significant 23% of tin supply over the last two decades and is the worlds second largest producer. The International Tin Association estimates Indonesia’s reserves at ~800kt, making it larger than Burma, or between ~16% to ~18.6% of world reserves. The remainder of the world accounts for around 23% of reserves.

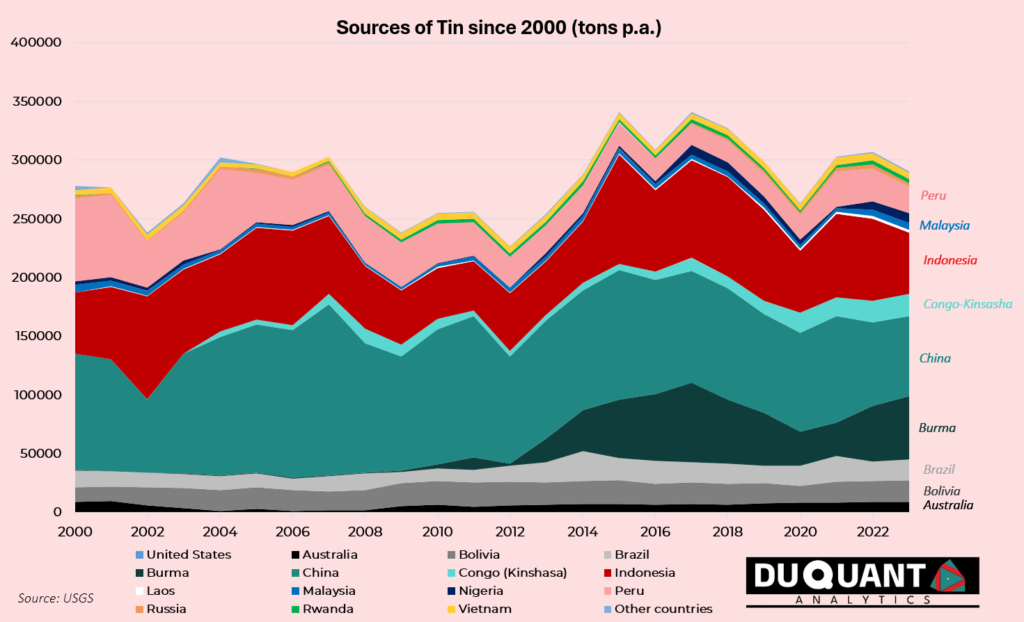

Since 2000, global tin mine supply has remained mostly flat, averaging 280kt over the last two decades, and around 300kt in the last 3 years. China has contributed 35% of all mined tin over this period, followed by Indonesia (23%), Peru (12%), Burma (8%), Bolivia (6%) and Brazil (5%). The remainder for the world supplied around 11% of primary mined supply.

A more or less flat growth rate for tin mine supply, coupled with a strong growth prospects places tin in a particular unique position for existing mines to benefit from tighter supplies. Important to note that recycling currently supplies around 60kt (17% of annual supply). Something else to keep in mind is that as technology has improved and semiconductors have advanced, this means that computer chips, phone and devices have gradually reduced in size and their tin needs have declined as well. Thus, even though semiconductor output has increased significantly in the last decade, the tin use per semiconductor has declined and caused tin use to remain mostly flat. Growth tailwinds for tin look positive and will be strongly driven by robotics, automation and renewable energy trends.

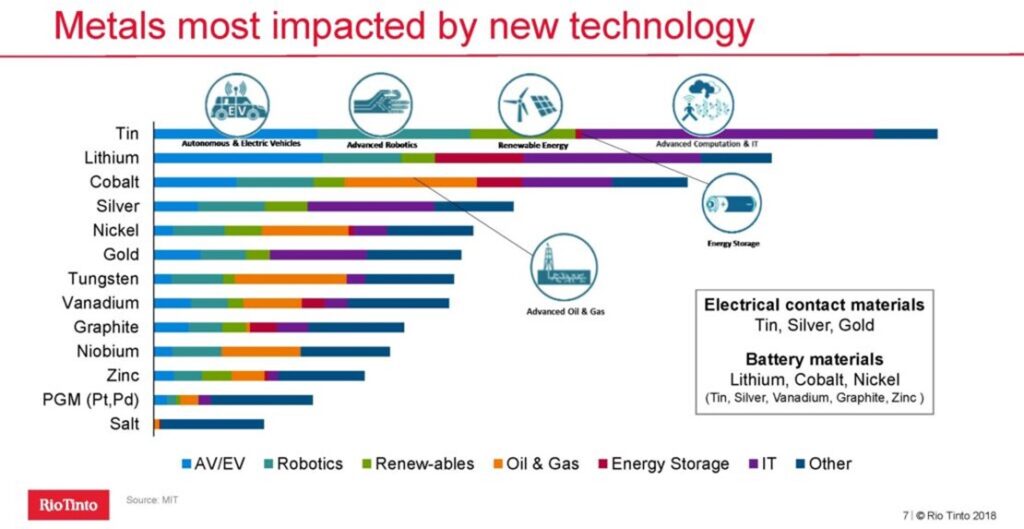

According to a Rio Tinto presentation in 2018 and a study conducted by MIT, Tin is one of the critical metals that are poised to be impacted the most by future technologies, largely driven by the IT, Robotics and EV sectors.

The Remarkable History of Tin

Tin, one of the earliest metals discovered and utilized by humans, has a rich history that stretches back thousands of years. Its journey from ancient civilizations to modern technological applications is a testament to its versatility and enduring value. This narrative highlights key events and milestones that have shaped the tin industry over the centuries.

The story of tin begins in the Bronze Age, around 3000 BCE, when ancient civilizations discovered that adding tin to copper produced bronze, a harder and more durable alloy. This discovery revolutionized tool-making, weaponry, and art, laying the foundation for advancements in human societies. The earliest known tin mines were located in the regions of modern-day Turkey, Iran, and Afghanistan. These early miners extracted cassiterite, the primary ore of tin, and traded it over long distances, indicating the high value placed on this metal. The use of tin spread throughout ancient Egypt, Mesopotamia, and the Indus Valley, where it played a crucial role in the development of advanced societies.

The classical era saw the expansion of tin trade networks, connecting distant regions and fostering cultural and technological exchanges. The Phoenicians, renowned for their seafaring and trade skills, were instrumental in transporting tin from the mines in the British Isles (particularly Cornwall) to the Mediterranean. This tin trade was vital for the Greek and Roman civilizations, which relied on bronze for military and domestic purposes.

During the Middle Ages, the use of tin expanded beyond bronze production. New applications and technological advancements emerged, driven by the demand for more efficient and durable materials. In medieval Europe, tin was increasingly used to produce pewter, an alloy of tin and lead, which became popular for making tableware and decorative items. Tin plating also emerged during this period, providing a corrosion-resistant coating for iron and steel, and extending the lifespan of various tools and utensils.

The Industrial Revolution brought about transformative changes in the production and application of tin, as new technologies and industrial processes emerged. One of the most significant developments was the invention of tin cans in the early 19th century. This innovation revolutionized food preservation and storage, making it possible to transport and store perishable goods for extended periods. The canning industry rapidly expanded, with tin-coated steel cans becoming ubiquitous in households and military rations.

Tin also became essential in the soldering process, where its low melting point made it ideal for joining metal parts in electrical and plumbing applications. The development of various tin-based alloys, such as tin-lead solder and tin-zinc alloys, further expanded its industrial uses.

The 20th century witnessed substantial growth in the production and application of tin, driven by technological advancements and increasing industrial demand. During World War II, tin was classified as a strategic material due to its critical role in producing military equipment and supplies. The demand for tin skyrocketed, leading to increased mining activities in Southeast Asia, particularly in Malaysia, Indonesia, and Thailand. The post-war era saw the diversification of tin applications. In the electronics industry, tin became essential for soldering electronic components, contributing to the rapid growth of consumer electronics. Tin compounds, such as tin oxide, found use in various industrial processes, including glass coating and ceramics production.

The late 20th and early 21st centuries have been characterized by a focus on sustainability and innovation in the tin industry. As environmental concerns grew, the tin industry began to adopt more sustainable practices. Efforts to reduce the environmental impact of tin mining and processing have led to the development of cleaner extraction methods and the recycling of tin-containing products. The use of tin in lead-free solders has also increased, driven by regulations aimed at reducing lead toxicity.

Technological advancements have continued to drive demand for tin. The development of advanced electronic devices, renewable energy technologies, and high-performance materials has underscored the importance of tin in modern industry. Tin’s role in producing touchscreens, solar panels, and electric vehicle batteries highlights its continued relevance in the 21st century.

The 2000s marked a significant rise in the use of tin in electronics, particularly with the transition to lead-free solders. The European Union’s Restriction of Hazardous Substances (RoHS) directive, implemented in 2006, banned the use of lead in electronics, leading to increased demand for tin as a safer alternative. This transition has had a lasting impact on the tin industry, driving innovation in soldering materials and techniques.

In the 2010s, the tin industry made strides toward more sustainable mining practices. The International Tin Association (ITA) launched initiatives to promote responsible tin mining, focusing on reducing the environmental and social impacts of tin extraction. These efforts have included better waste management practices, reducing water usage, and improving the livelihoods of communities involved in tin mining.

The 2020s have seen a growing emphasis on tin’s role in renewable energy technologies. Tin is a crucial component in the production of perovskite solar cells, which offer higher efficiency and lower costs compared to traditional silicon-based solar cells. Research into tin-based energy storage solutions, such as advanced batteries, is also ongoing, highlighting tin’s potential to contribute to a more sustainable energy future.

Looking ahead, tin’s role in advanced technologies and sustainability is set to expand. Research and development efforts are focused on improving the performance of tin-based materials, enhancing recycling methods, and exploring new applications in emerging fields such as nanotechnology and advanced manufacturing.

From its ancient use in bronze to its critical role in modern electronics and renewable energy, tin’s journey is a testament to its versatility and enduring value. Its story reflects the dynamic interplay between scientific discovery and technological advancement, shaping the future of industries ranging from food preservation to cutting-edge technology. As the world continues to prioritize sustainability and innovation, tin’s importance is poised to grow, driving progress and transforming possibilities across a wide range of applications.

Download This Post in PDF

RESEARCH DISCLOSURE

Purpose: DUQUANT ANALYTICS (PTY) LTD provides research notes and newsletters for market insights, analysis, informational, educational, and research purposes only. We adhere to the CFA Institute’s Code of Ethics and Standards of Professional Conduct which includes maintaining the highest standards of integrity, transparency and professionalism in all research activities. We strive to ensure that our investment analysis and actions remain unbiased and focused on delivering accurate information based on available knowledge at the time of release. We follow industry accepted methodologies for conducting due diligence and conduct our analysis on a reasonable basis.

Investor Responsibility and Limitation of Liability: This content does not constitute a recommendation to buy or sell any securities. It is essential to understand the nature of our research, which is for educational and informative purposes. It is imperative to conduct your own due diligence and research prior to making any investment. DUQUANT ANALYTICS (PTY) LTD is not liable for any losses incurred from using our research. Information released is believed to be reliable, but not guaranteed for accuracy or completeness. It is also important to note that past performance is not reflective of future performance.

Potential Conflict of Interest: Personal Investments: Members of DUQUANT ANALYTICS (PTY) LTD may hold positions in some of the assets or securities mentioned in our research notes and newsletters. This includes equities, bonds, commodities and other financial instruments. Despite any personal investments, our research is conducted with the highest level of integrity, independence and objectivity. We strive to ensure that our analysis remains unbiased by focusing on accurate, public and provable information and secondary data as it is released or becomes public.

Conclusion: DUQUANT ANALYTICS (PTY) LTD is committed to providing high-quality research and insights to our readers. However, it is essential for investors to take responsibility for their own investment decisions and to understand the inherent risks involve, especially in mining which carries more risk than traditional assets. We encourage you to consult with a qualified financial advisor and to perform thorough research before making any investments.

Thank you for reading this disclosure note. We value your trust and strive to maintain the highest standards of integrity in all our research activities.